How Do Bank Make Money Bank Banks Money Does Make Work Much Why So

Encrypting your link and protect the link from viruses, malware, thief, etc! Made your link safe to visit.

Banking has been around for centuries, but many of us still don't fully understand how it works. Have you ever wondered how banks make so much money, and where they really put our deposits? In this article, we're going to dive deep into the world of banking and uncover some fascinating facts about how banks operate.

Where Do Banks Put My Deposits?

When you deposit money into a bank account, you become a creditor of the bank. This means that the bank owes you money, and must keep your deposit safe and available for withdrawal. However, banks don't just let your money sit idly in a vault. Instead, they use a portion of your deposit to make loans to other customers. This is a process known as fractional reserve banking, and it's what allows banks to facilitate economic growth and development.

But where exactly do banks put your deposits? Contrary to popular belief, banks don't actually keep large sums of cash on hand. Instead, they deposit the majority of your money into accounts with the Federal Reserve or other central banks. These accounts earn interest, which helps to offset the costs of running a bank and makes up a significant portion of a bank's revenue.

How Do Banks Make Money?

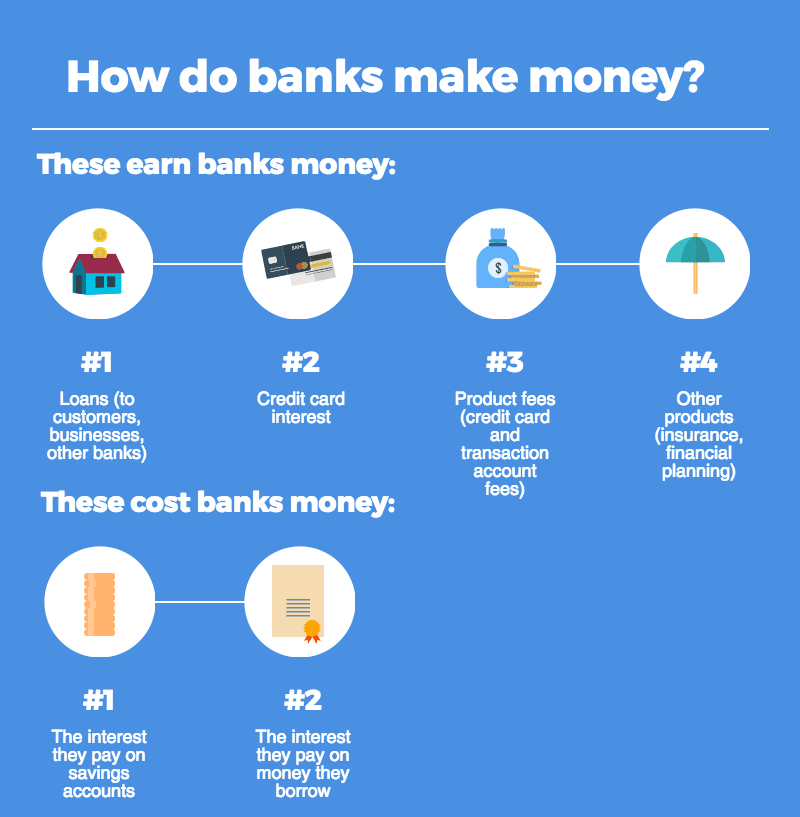

Now that we know where banks put our deposits, let's explore how they make money. There are actually a variety of ways that banks generate revenue, including:

- Interest on loans: When a bank makes a loan to a customer, it charges interest on that loan. This interest is essentially the cost of borrowing money, and it's one of the primary ways that banks earn revenue.

- Interchange fees: Banks also earn money by charging merchants interchange fees when customers use their debit or credit cards. These fees can range anywhere from 1-3% of the transaction amount, and they add up to a significant amount of revenue for banks.

- Investment banking: Some banks also engage in investment banking activities, such as underwriting new securities or advising on mergers and acquisitions. These activities can generate large fees for banks, but they also come with a higher level of risk.

- Account fees: Lastly, banks may charge customers various fees for maintaining their accounts, such as monthly maintenance fees or overdraft fees. While these fees may seem small, they can add up to a significant amount of revenue for banks over time.

How Does a Bank Work?

Now that we understand how banks make money, let's discuss how they actually work. Banks serve as intermediaries between customers who have excess funds and those who need to borrow money. When a customer deposits money into a bank account, the bank uses a portion of that deposit to make loans to other customers. This creates a cycle of lending and borrowing that fuels economic growth and development.

Banks also play a key role in keeping the economy stable. When banks make loans, they create new money that can stimulate economic activity. However, if banks lend too much money or make risky loans that lead to defaults, it can have a negative effect on the economy. For this reason, banks are heavily regulated by both state and federal agencies to ensure that they operate in a safe and sound manner.

Tips for Managing Your Bank Account

Now that we've explored the inner workings of banks, let's discuss some tips for managing your bank account.

- Keep track of your account balance: It's important to know how much money you have in your account at all times so that you don't overdraw or have unexpected fees.

- Review your account activity regularly: Be sure to check your account activity on a regular basis to make sure that all transactions are legitimate.

- Choose a bank that fits your needs: Not all banks are created equal, so be sure to choose one that offers the products and services that you need at a price you can afford.

- Avoid unnecessary fees: By keeping your account in good standing and avoiding overdrafts, you can save yourself a significant amount of money in fees over time.

Conclusion

So there you have it – a brief overview of how banks work and how they make money. While banking may seem complex, understanding the basics can help you make informed decisions about your own finances. By keeping these tips in mind, you can manage your bank account effectively and avoid unnecessary fees and charges. Happy banking!

If you are searching about Best Online Savings Accounts for 2020 - DollarSprout | Online savings you've visit to the right web. We have 7 Pictures about Best Online Savings Accounts for 2020 - DollarSprout | Online savings like How Do Banks Make Money?, Best Online Savings Accounts for 2020 - DollarSprout | Online savings and also Best Online Savings Accounts for 2020 - DollarSprout | Online savings. Read more:

Best Online Savings Accounts For 2020 - DollarSprout | Online Savings

www.pinterest.com

www.pinterest.com savings saving dollarsprout

How Does A Bank Work, And Why Do Banks Make So Much Money? - YouTube

www.youtube.com

www.youtube.com bank banks money does make work much why so

How Do Banks Make Money? Here's 11 Ways | Ventured

ventured.com

ventured.com ventured

How Bank Works

bank deposits

Where Do Banks Put My Deposits?

www.joinatmos.com

www.joinatmos.com How Do Banks Make Money?

mint.intuit.com

mint.intuit.com How Do Banks Make Money In Australia? | Finder

www.finder.com.au

www.finder.com.au How do banks make money?. Where do banks put my deposits?. How bank works

0 Response to "How Do Bank Make Money Bank Banks Money Does Make Work Much Why So"

Post a Comment

Dont Spam in Here Ok...!!!