Business Working From Home Expenses The Essential Business Expenses List: Common Monthly Expenses

Encrypting your link and protect the link from viruses, malware, thief, etc! Made your link safe to visit.

Working from home can be so liberating. You get to set your own schedule, work in your pajamas, snack throughout the day without getting judged, but it has its downsides like figuring out expenses. You might be wondering how to calculate your expenses while working from home without losing your mind. Don't worry; we got you covered! Below are some tips and ideas to make the process less daunting.

The first expense to note is your home office setup

The amount of money you spent on your home office setup is tax-deductible, and it covers things like your desk, chair, computer, and other office supplies. To qualify, the space must be used exclusively for business purposes and must be your primary place of work.

Now that you know you can claim your home office setup, it's time to start tracking your expenses. Keep all your receipts and invoices related to your office setup and calculate the total amount spent over the year.

Internet and phone expenses are also tax-deductible

If you're working from home, you're probably using your phone and the internet more than usual. Lucky for you, those costs are also tax-deductible! To know how much you can deduct, calculate the total amount you spent on phone and internet expenses and multiply it by the percentage of time you spend on work-related activities.

For example, if you spent $100 on your phone and internet bill for the month and spent 70% of your time working, you can claim a deduction of $70. Keep in mind that this deduction only applies to the portion of your phone and internet cost used for work purposes.

Don't forget about your utility bills

Since you're staying at home more often, you might notice that your utility bills are higher than usual. Don't fret! You can claim a deduction on your utility bills for your home office space based on the percentage of your home used for business purposes. However, this only applies if you work from home for more than half of the year and your home office is your primary workspace.

Keep track of your utility bills for the year, including electricity, gas, and water. Calculate the total cost and multiply it by the percentage of your home used for work. The result is the amount you can claim as a tax deduction for your utility bills.

Food and drink expenses aren't tax-deductible (unless...)

Before you start celebrating your snack budget, let us break it to you that food and drink expenses aren't tax-deductible. So, don't go crazy on your snack bar just yet. However, meals and entertainment expenses are deductible, but with restrictions.

For example, if you meet with a client over lunch, you can deduct 50% of the cost of the meal. However, the meal must be reasonable in cost, and the primary purpose of the meeting should be business-related. Keep all your receipts and make a note of who you met and what you discussed during the meal.

Get organized

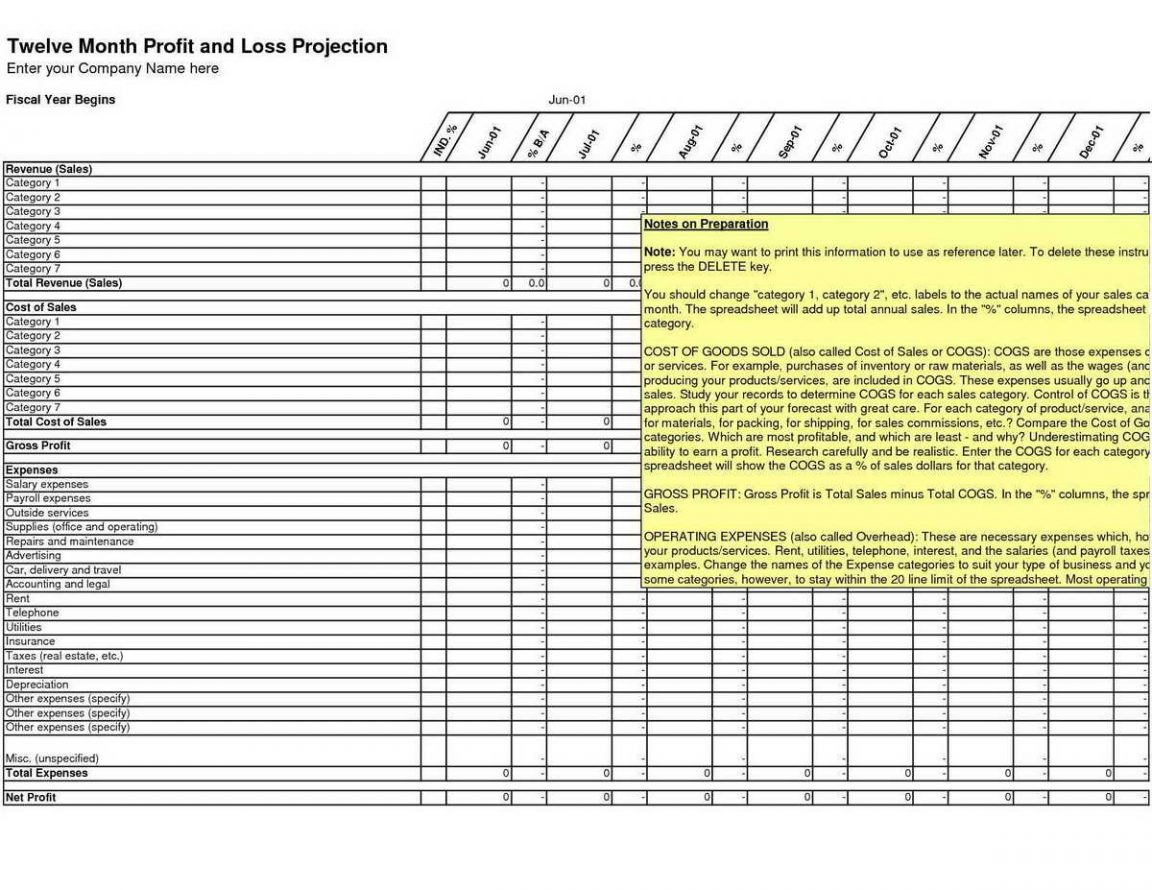

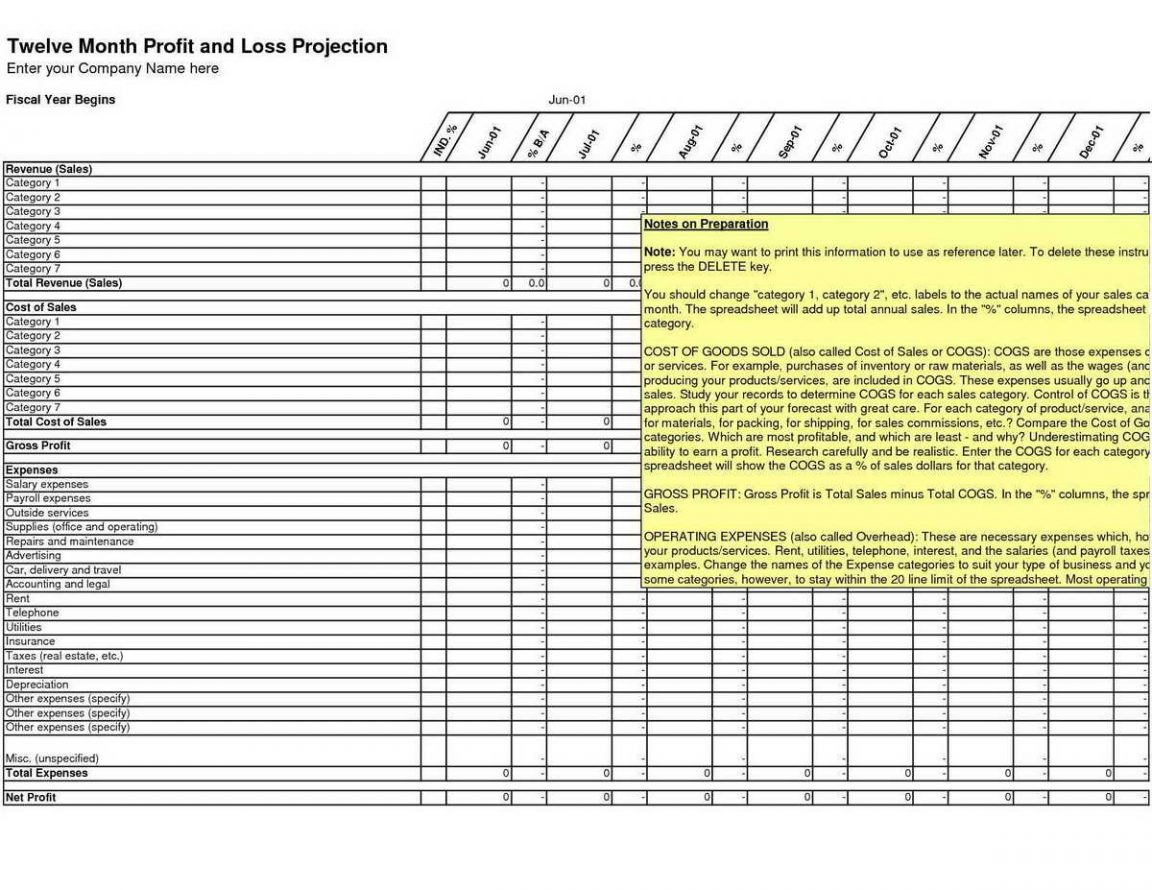

Tracking your expenses can be overwhelming and confusing if you're not organized. So, get a system in place to make it easier for you. Keep all your receipts and invoices in one place, and make a spreadsheet to track all your expenses.

Make a habit of entering expenses regularly to avoid a backlog of receipts piling up and causing you headaches at tax time. Also, make sure to back up your data regularly to avoid losing any important information.

Conclusion

Calculating your expenses while working from home can be daunting, but with these tips and ideas, you can make the process less stressful. Keep track of your expenses and get organized to avoid any tax headaches. Remember to keep all your receipts and invoices, and always consult with a tax professional if you're unsure about any deductions.

If you are searching about Self Employed Expenses - What can you claim? | Debitoor Blog you've came to the right web. We have 7 Pictures about Self Employed Expenses - What can you claim? | Debitoor Blog like Working From Home Expenses You Can Claim - Hive Business, How do I calculate my working from home expenses? | Working from home and also Tax Expenses Spreadsheet with regard to Business Expense Spreadsheet. Here you go:

Self Employed Expenses - What Can You Claim? | Debitoor Blog

debitoor.com

debitoor.com expenses employed claim self space business debitoor costs outfitting necessary purchasing hours equipment

Working From Home Expenses You Can Claim - Hive Business

hivebusiness.co.uk

hivebusiness.co.uk working expenses claim insights

Tax Expenses Spreadsheet With Regard To Business Expense Spreadsheet

db-excel.com

db-excel.com template tax spreadsheet expenses expense business regard excel db next

Part 2: How To Prepare Business Taxes For Self-Employed Individuals

expenses office business employed self prepare taxes individuals part line

Business Expenses For Small Businesses - Company Bug

www.companybug.com

www.companybug.com expenses business small company claimed commonly guides most some

How Do I Calculate My Working From Home Expenses? | Working From Home

www.pinterest.com

www.pinterest.com expenses business work working calculate freeagent

The Essential Business Expenses List: Common Monthly Expenses

dealstruck.com

dealstruck.com expenses expense driving dietas nagel mediafeed debt owe prioritizing contratistas jda

Working expenses claim insights. Expenses expense driving dietas nagel mediafeed debt owe prioritizing contratistas jda. Expenses employed claim self space business debitoor costs outfitting necessary purchasing hours equipment

0 Response to "Business Working From Home Expenses The Essential Business Expenses List: Common Monthly Expenses"

Post a Comment

Dont Spam in Here Ok...!!!