Gst For Business From Home Gst India Benefits Tax Economy Indian Benefit Advantage Goods Services Business Good Advantages Under Government Key Boost Who Bill Form

Encrypting your link and protect the link from viruses, malware, thief, etc! Made your link safe to visit.

Are you curious about the benefits of GST in India for 2019? Look no further! Check out these amazing advantages that can help your business grow.

GST Benefits in India

First and foremost, the Goods and Services Tax (GST) helps eliminate the cascading effect of taxes. With the previous tax system, taxes were levied on top of each other, which increased the burden on the end consumer. This was especially problematic for small businesses who had to pay taxes at every step of the supply chain. With GST, every business can claim a credit for taxes paid on purchases, which allows for more affordable prices for consumers.

In addition, GST promotes ease of doing business. The previous tax system was highly complex and confusing for newcomers to the market, which kept many potential entrepreneurs from starting businesses. With GST, the tax process is streamlined and easier to understand, which encourages more people to enter the market and start their own businesses.

Is Your Business GST Ready?

If you're running a business in India, it's crucial to ensure that you're GST ready. This means that your business is compliant with the GST regulations and is registered for GST. Being GST ready is important because it allows you to claim credits for taxes paid on your purchases and ensures that you are not penalized for non-compliance.

To become GST ready, you must first obtain a GST identification number (GSTIN). This can be done online through the GST portal. Once you have your GSTIN, you must ensure that all your invoices comply with the GST rules. This includes providing specific details on your invoices, such as your GSTIN, the customer's GSTIN, and the amount of the GST charged.

Homebuyers and GST

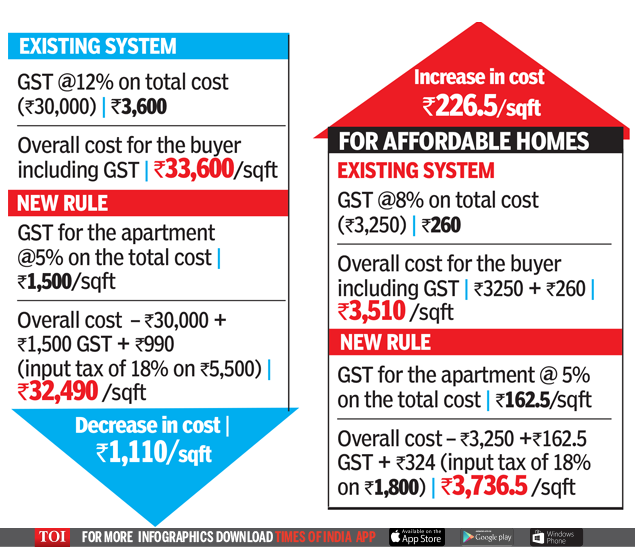

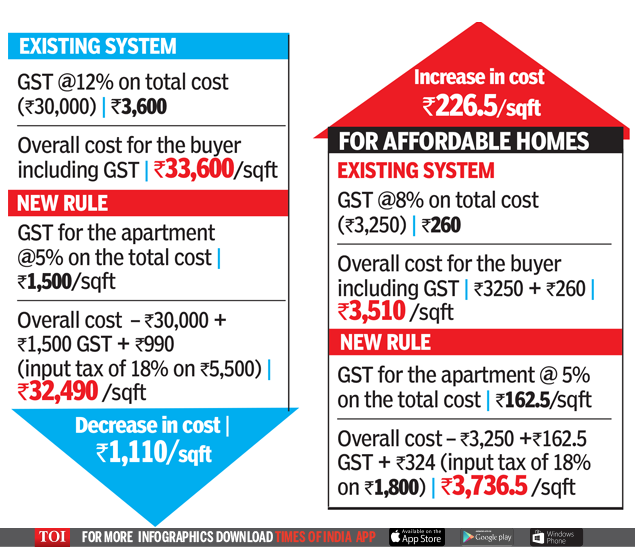

Although reducing GST on homebuyers may seem like a good thing at first, it can actually end up being quite costly for your budget. Under the new tax regime, free samples are also treated differently. Let's take a look at both scenarios.

Reduced GST for Homebuyers

Initially, reducing GST on homebuyers seems like a positive thing. However, the reduction of GST may cause developers to increase the base price of homes, which will offset the benefit of the reduced tax rate. For example, if the base price of a home is increased by 10%, the reduction of the GST rate from 12% to 5% will only result in a 5% reduction in the final price. Therefore, it's important to be cautious when it comes to reduced tax rates.

GST on Free Samples

Under the new GST regime, free samples are treated differently than before. Previously, free samples were exempt from tax if they were given "without consideration". However, under GST, free samples are considered a "supply" and are therefore subject to tax. Businesses must pay tax on the cost of the free samples and must file a separate tax return for them. This can be costly and may discourage businesses from offering free samples.

E-commerce and GST

The implementation of GST has had a significant impact on e-commerce in India. Here are some frequently asked questions about e-commerce and GST:

Do I need to register for GST if I sell goods on an e-commerce platform?

Yes, if you sell goods on an e-commerce platform, you must register for GST just like any other business. However, if you are a small business with an aggregate turnover of less than Rs. 20 lakhs (Rs. 10 lakhs for special category states), you are exempt from registering for GST.

How do I file my GST returns for e-commerce sales?

If you sell goods on an e-commerce platform, you will need to file your GST returns for each state separately. This can be done through the GST portal, and it's important to ensure that you have all the necessary information, such as your GSTIN, the GSTIN of your customers, and the amount of GST charged.

Do I need to pay tax on my shipping charges?

Yes, shipping charges are considered a part of the sale and are therefore subject to tax. You must charge GST on your shipping charges and include them in your tax returns.

Conclusion

Overall, GST has had a significant impact on the business landscape in India. It has helped eliminate the cascading effect of taxes and has made it easier for businesses to comply with tax regulations. However, it's important to be aware of the potential pitfalls, such as the increased base prices for homes and the treatment of free samples under the new tax regime.

Being GST ready is crucial for the success of your business, and it's important to ensure that you understand all the rules and regulations surrounding GST. By taking the necessary steps to become GST compliant, you can ensure that your business is on the path to success.

If you are looking for Gst Benefits in India in 2019 - Advantages of Gst in India you've visit to the right place. We have 7 Images about Gst Benefits in India in 2019 - Advantages of Gst in India like Know If your Business GST is Ready? (Detailed Blog), Homestays to go under GST, service providers upset and also Here is the Impact of Goods and Services Tax on Home Loan Customers. Here you go:

Gst Benefits In India In 2019 - Advantages Of Gst In India

www.anakeen.net

www.anakeen.net gst india benefits tax economy indian benefit advantage goods services business good advantages under government key boost who bill form

GST On Homebuyers: Why Reduced GST Will Prove Costly For Budget

timesofindia.indiatimes.com

timesofindia.indiatimes.com gst prove costly reduced budget why homebuyers

FAQ On E Commerce Gst - Blog

blog.caonweb.com

blog.caonweb.com gst compliance expert tax services sign contact

Here Is The Impact Of Goods And Services Tax On Home Loan Customers

www.affordablehomesgurgaon.in

www.affordablehomesgurgaon.in gst tax services before loan affordable

GST And You: How Are Free Samples Treated Under The New Tax Regime

gst under tax india chinese regime treated samples standard business affect decline gas come natural read also

Know If Your Business GST Is Ready? (Detailed Blog)

certicom.in

certicom.in gst certicom business duty shops probable seems covered under september debit revenue secretary paid credit cards using ready know gstr

Homestays To Go Under GST, Service Providers Upset

certicom.in

certicom.in gst service homestays certicom under go upset providers tax goods services

Gst under tax india chinese regime treated samples standard business affect decline gas come natural read also. Gst and you: how are free samples treated under the new tax regime. Gst tax services before loan affordable

0 Response to "Gst For Business From Home Gst India Benefits Tax Economy Indian Benefit Advantage Goods Services Business Good Advantages Under Government Key Boost Who Bill Form"

Post a Comment

Dont Spam in Here Ok...!!!