How Does A Roth Ira Make Money Roth Ira Benefits Key Graphic

Encrypting your link and protect the link from viruses, malware, thief, etc! Made your link safe to visit.

A Roth IRA is a type of individual retirement account that has been growing in popularity among those who are planning for their financial future. While it may not be suitable for everyone, a Roth IRA offers several benefits that make it an attractive investment option for many people.

What is a Roth IRA?

A Roth IRA is a retirement savings account that allows you to contribute after-tax income. This means that you don't get a tax deduction for your contributions, but you also won't have to pay taxes on your withdrawals in retirement. This is different from traditional IRAs, which allow you to contribute pre-tax income and then pay taxes on your withdrawals.

How does it work?

When you open a Roth IRA, you can contribute up to a certain amount each year, depending on your age and income level. For 2021, the maximum contribution is $6,000 if you're under 50, or $7,000 if you're 50 or older. You can choose to invest your contributions in a variety of assets, including stocks, bonds, and mutual funds.

Benefits of a Roth IRA

One of the biggest benefits of a Roth IRA is that you won't have to pay taxes on your withdrawals in retirement. This means that you can withdraw the money you've saved without worrying about how much of it will go towards taxes. Additionally, a Roth IRA allows you to continue contributing to the account even after you reach age 70 1/2, which is not allowed with a traditional IRA.

Tips for investing in a Roth IRA

There are several things to keep in mind when investing in a Roth IRA. First, make sure you're contributing as much as you can afford each year. The more you save, the better off you'll be in retirement. Second, consider diversifying your investments across different asset classes to reduce your risk. Finally, review your investments on a regular basis and make adjustments as needed based on your age, risk tolerance, and financial goals.

How to open a Roth IRA

If you're interested in opening a Roth IRA, you can do so through a bank, brokerage firm, or other financial institution. To get started, you'll need to provide some basic personal and financial information, such as your name, address, Social Security number, and employment information. You'll also need to choose how you want to invest your contributions, such as in stocks, bonds, or mutual funds.

Is a Roth IRA right for you?

A Roth IRA is a great option for anyone who wants to save for retirement while minimizing their tax liability. However, it may not be the best option for everyone. If you're in a high tax bracket now and expect to be in a lower tax bracket in retirement, a traditional IRA may be a better choice. Additionally, if you need the tax deduction now to lower your taxable income, a traditional IRA may be more beneficial.

Ultimately, the best way to determine whether a Roth IRA is right for you is to speak with a financial advisor. They can help you evaluate your current financial situation, identify your goals for retirement, and recommend the best investment options for your needs.

In conclusion, a Roth IRA is a powerful tool for anyone who wants to save for retirement while avoiding taxes on their withdrawals. If you're interested in opening one, make sure to do your research, consider your investment options, and seek advice from a financial professional if needed. With the right approach, a Roth IRA can help you build a secure financial future and achieve your retirement goals.

If you are searching about What Is a Roth IRA? | Money.com you've visit to the right place. We have 7 Pictures about What Is a Roth IRA? | Money.com like How Does Roth IRA Compound Interest?, How your money can grow in an IRA | Roth ira calculator, Traditional and also What is a Roth IRA? - The Fancy Accountant. Read more:

What Is A Roth IRA? | Money.com

money.com

money.com ira roth money open chart garcia rangely

Roth-ira-limits-married-2020 | Your Financial Pharmacist

yourfinancialpharmacist.com

yourfinancialpharmacist.com roth ira limits married filing jointly backdoor income conversion pharmacists should why most contributions make contribute tax years

How Your Money Can Grow In An IRA | Roth Ira Calculator, Traditional

www.pinterest.com

www.pinterest.com ira roth grow

What Is A Roth IRA And Do You Really Need One? - Adopting A Lifestyle

www.pinterest.com

www.pinterest.com roth ira really need start steps visit easy set

How Does Roth IRA Compound Interest?

www.thewowstyle.com

www.thewowstyle.com ira backdoor roth interest does compound iras traditional money set conversion tax wealth vehicles building around why earn nerdwallet

How Does A Roth IRA Work? Roth IRA Explained. - YouTube

www.youtube.com

www.youtube.com roth ira explained

What Is A Roth IRA? - The Fancy Accountant

fancyaccountant.com

fancyaccountant.com roth ira benefits key graphic

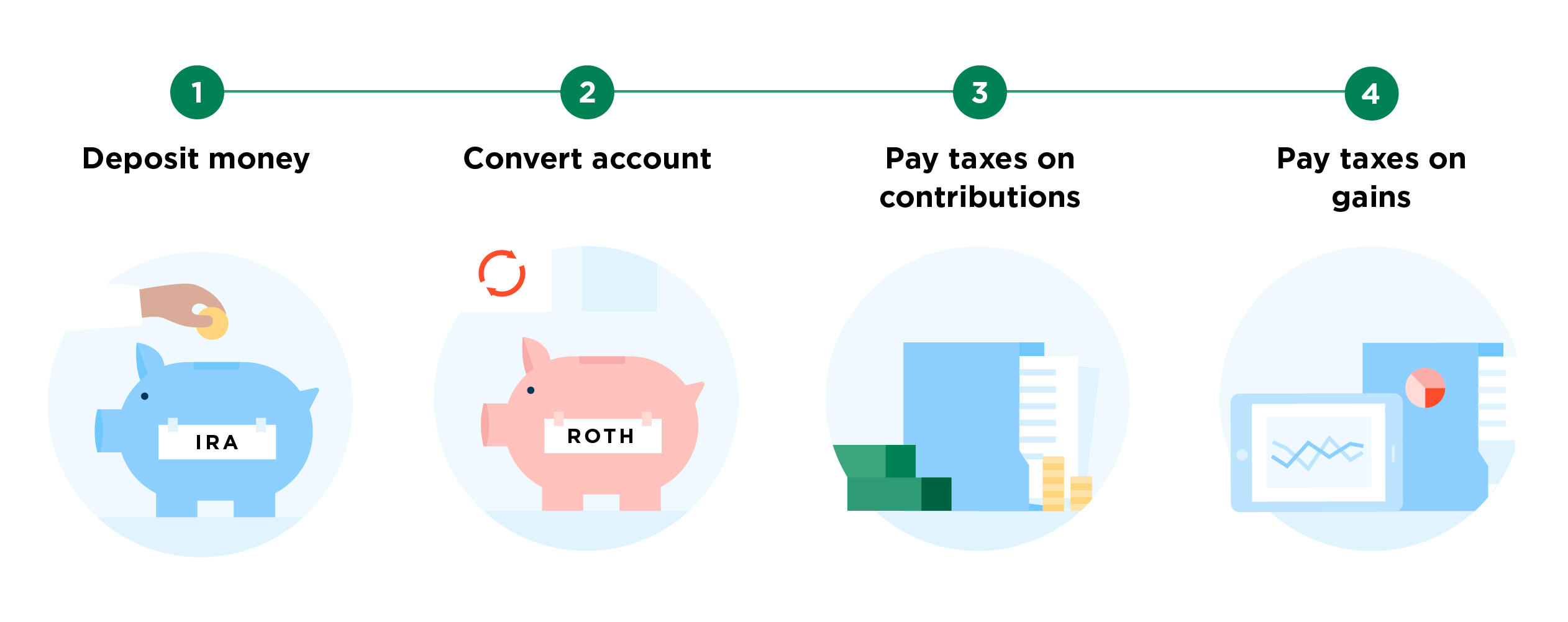

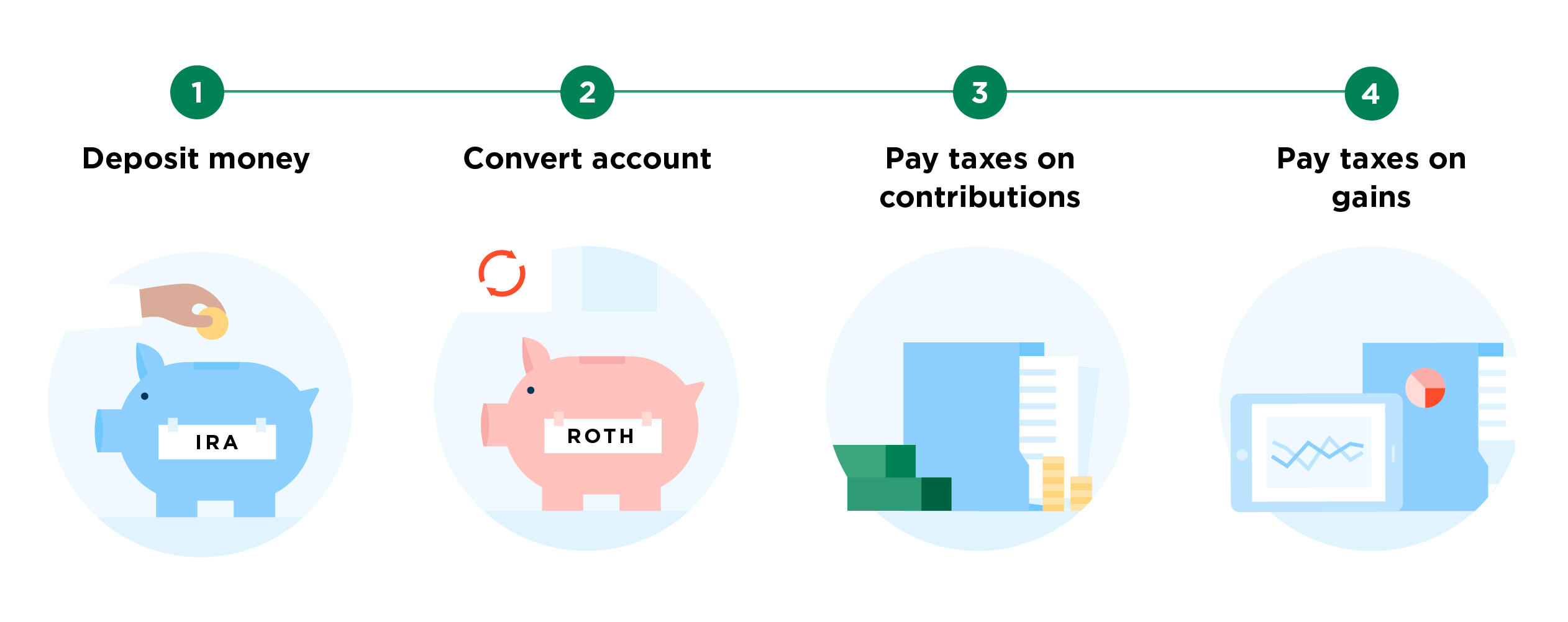

What is a roth ira?. What is a roth ira?. Roth ira benefits key graphic

0 Response to "How Does A Roth Ira Make Money Roth Ira Benefits Key Graphic"

Post a Comment

Dont Spam in Here Ok...!!!