Business Use Of Home 8829 Expenses Freshbooks

Encrypting your link and protect the link from viruses, malware, thief, etc! Made your link safe to visit.

Starting a business can be an exciting and challenging prospect. As you begin to navigate through the myriad of tasks, one of the important aspects to consider is the expenses for the business use of your home. In this post, we’ll be taking a closer look at IRS Form 8829 and how to fill it out correctly.

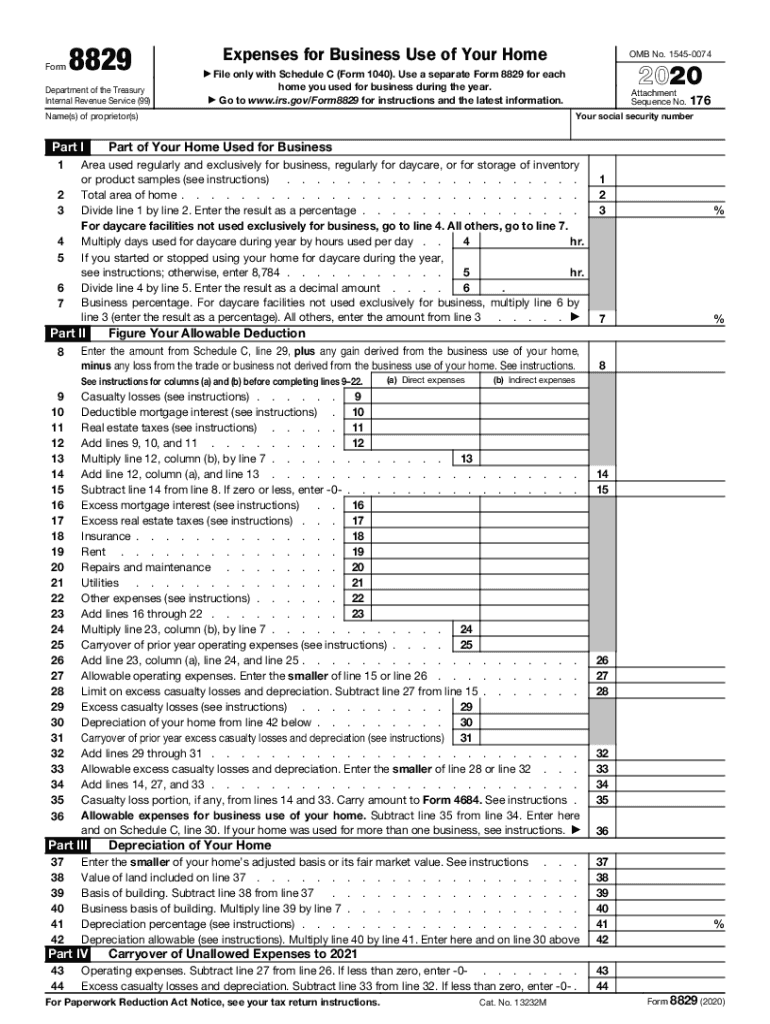

What is IRS Form 8829?

Before diving into how to fill out this form, let's first understand what it is and its purpose. IRS Form 8829 is the Expenses for Business Use of Your Home form. It is used to claim deductions for all the expenses incurred to operate and maintain your home business.

How to Fill Out IRS Form 8829

Now that we understand the purpose of Form 8829, let's delve into the process of filling it out step by step.

Step 1 - Calculate Your Home Office Expense

The first step in filling out this form is calculating your home office expense. The expenses could include rent, insurance, mortgage interest, and property taxes, among others. To calculate these expenses, you need to determine the percentage of your home that is dedicated to your business. The expenses are then calculated based on that percentage.

Step 2 - Determine Your Depreciation Expense

Depreciation expenses refer to the wear and tear of your home office equipment. To calculate these expenses, you need to determine the useful life of your equipment, and then divide the cost by that number.

Step 3 - Fill out Form 8829

Once you have determined your home office expense and your depreciation expense, you can now fill out the 8829 form. The form requires you to provide information on your home office space, the expense you are claiming, and the amount of time you have used that space. Make sure that you double-check the information before submitting the form as submitting wrong information can have serious consequences.

Tips for Filling Out IRS Form 8829

Here are some tips that can help you successfully fill out IRS Form 8829:

Keep Accurate Records

It is essential that you keep accurate records of all your expenses, including receipts and invoices. This documentation will help you avoid making mistakes while filling out the form, and it is also crucial during an audit.

Ensure Your Business Meets IRS Requirements

For expenses to qualify for a home office deduction, your business must meet certain IRS requirements. Ensure that your business passes the exclusive and regular use test, which requires the space to be regularly used for business purposes, and exclusively used for that purpose.

Hire a Professional to Help You

If you're not confident about filling out the form, consider hiring a professional tax preparer. They can give you the guidance you need to ensure that you are maximizing all the deductions you are entitled to.

Ideas to Maximize Your Deductions

Here are some ideas that can help you maximize your deductions:

Take Advantage of the Simplified Home Office Deduction

If you do not run a large business, you could take advantage of the simplified home office deduction. This option allows you to deduct $5 per square foot of the home office space, up to a maximum of 300 square feet.

Document Your Home Office Space Thoroughly

Ensure that you document your home office space thoroughly. This documentation should include photographs of your home office and a written description, to support your claim if you are audited.

Consider Other Deductions

Examine your business operations closely to see if there are other deductions that you could take advantage of. For example, you could deduct the cost of your internet service, phone services, and office supplies.

/https://cdn.autonomous.ai/static/upload/images/new_post/what-is-tax-form-8829-for-business-4374-1649411167947.jpg)

How to Make Sure Your Deductions Are Accepted

Here are some tips to ensure that your deductions are accepted:

Be Accurate

Make sure that you are accurate while filling out the 8829 form. Calculate your expenses and depreciation costs correctly, and read through the form before you submit it.

Provide Adequate Documentation

Ensure that you have adequate documentation to support your claims. This documentation should include receipts, invoices, and other documentation necessary for an audit.

Avoid Overstating Your Deductions

Avoid the temptation to overstate your deductions. This can lead to penalties and other legal consequences. Only claim deductions that you are entitled to.

Conclusion

IRS Form 8829 is a crucial form for home-based business owners. It allows you to claim deductions for all the expenses incurred for operating and maintaining your home-based business. Filling out this form is not complicated, but it requires that you be accurate and thorough. By following the tips and ideas outlined in this post, you can maximize your deductions and ensure that your return is accurate and accepted.

If you are looking for U.S. Tax Form 8829—Expenses for Business Use of Your Home | FreshBooks Blog you've visit to the right web. We have 7 Pictures about U.S. Tax Form 8829—Expenses for Business Use of Your Home | FreshBooks Blog like What Is Tax Form 8829 for Business Use of Home Expenses?, Form 8829 Expenses For Business Use Of Your Home - Fill Out and Sign and also Home Office Deduction YouTube Business ★ Business Use of Home Explained. Read more:

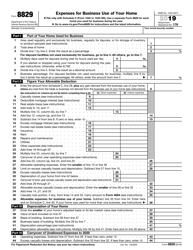

U.S. Tax Form 8829—Expenses For Business Use Of Your Home | FreshBooks Blog

www.freshbooks.com

www.freshbooks.com expenses freshbooks

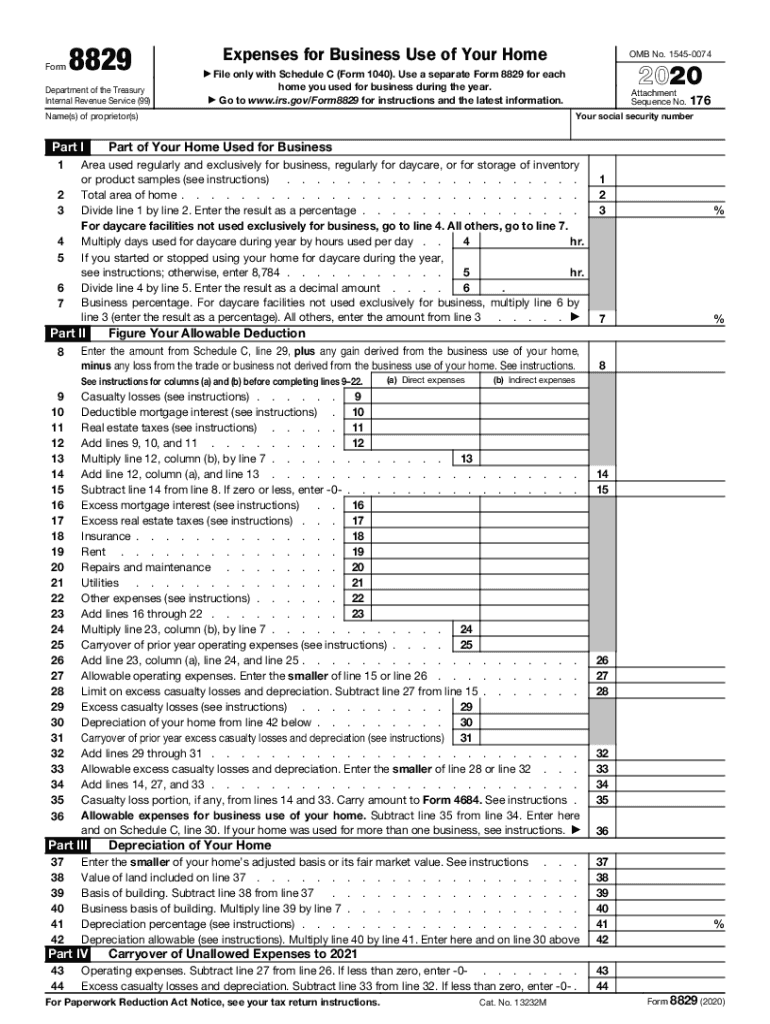

IRS Form 8829 Download Fillable PDF Or Fill Online Expenses For

www.templateroller.com

www.templateroller.com irs expenses templateroller

Form 8829 Expenses For Business Use Of Your Home - Fill Out And Sign

www.signnow.com

www.signnow.com irs 8829 expenses deduction simplified instructions pdffiller signnow fillable

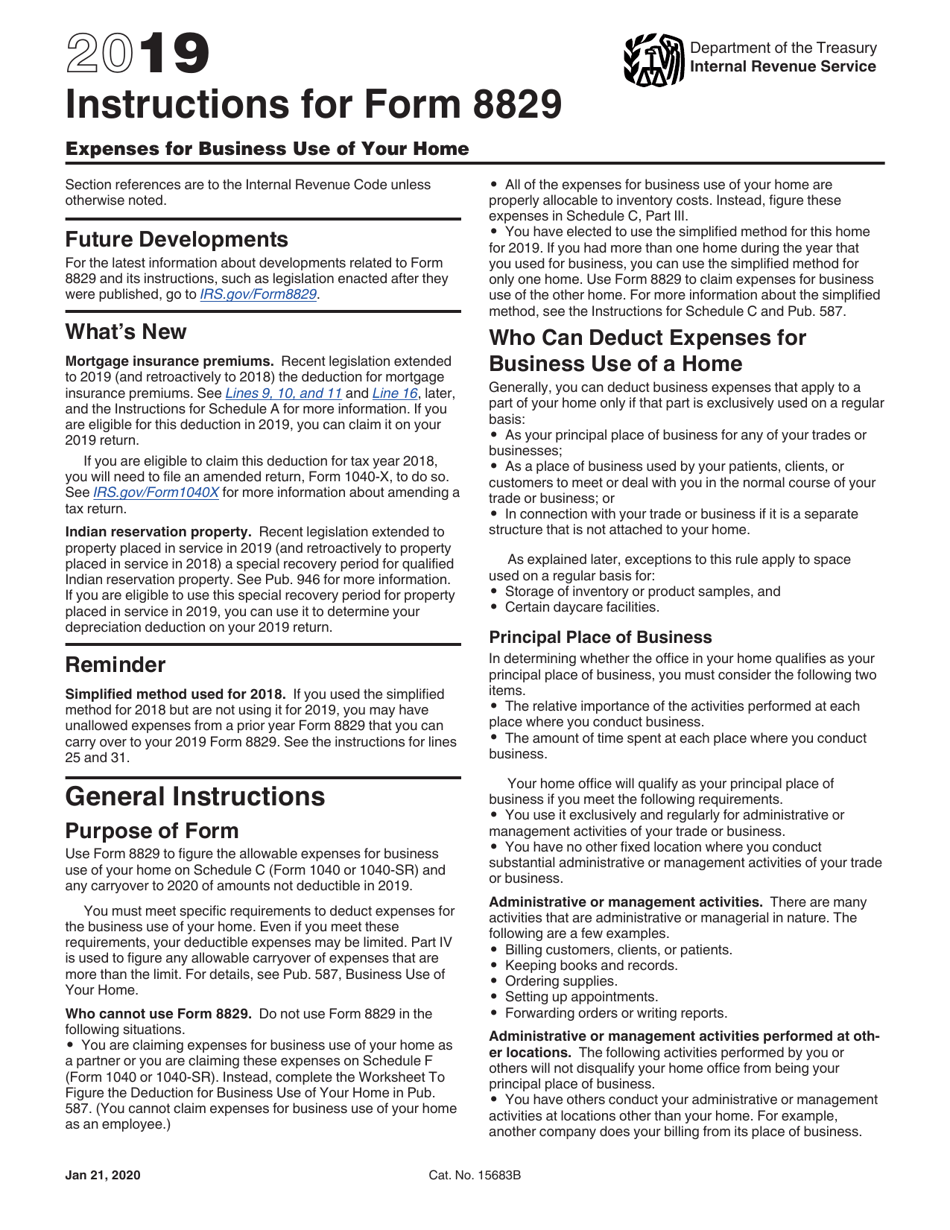

Download Instructions For IRS Form 8829 Expenses For Business Use Of

www.templateroller.com

www.templateroller.com templateroller expenses irs

What Is Tax Form 8829 For Business Use Of Home Expenses?

/https://cdn.autonomous.ai/static/upload/images/new_post/what-is-tax-form-8829-for-business-4374-1649411167947.jpg) www.autonomous.ai

www.autonomous.ai Home Office Deduction YouTube Business ★ Business Use Of Home Explained

www.youtube.com

www.youtube.com How To Claim The Home Office Deduction With Form 8829 | Ask Gusto

gusto.com

gusto.com deduction gusto allowable

Home office deduction youtube business ★ business use of home explained. Deduction gusto allowable. Download instructions for irs form 8829 expenses for business use of

0 Response to "Business Use Of Home 8829 Expenses Freshbooks"

Post a Comment

Dont Spam in Here Ok...!!!