Business Use Of Home Form 8829 Form Deduction Office Ii Part Gusto Allowable Figure Irs

Encrypting your link and protect the link from viruses, malware, thief, etc! Made your link safe to visit.

Welcome, all! Are you one of the many people who work from home? If so, then you might be eligible for a home office deduction on your taxes. But where do you begin? Fear not! In this post, we will take you through the steps of claiming the home office deduction using Form 8829.

What Is Form 8829?

Form 8829 is a form used to calculate the business use of your home. If you use part of your home for business purposes, you may be able to deduct some of the costs associated with maintaining your home. This can include expenses such as rent, mortgage interest, utilities, and maintenance costs.

Instructions for Form 8829

The first step to claiming the home office deduction is to obtain a copy of Form 8829. You can find the form on the IRS website, or you can use one of the many tax preparation software programs on the market.

IRS Forms and Schedules You'll Need

Once you have your copy of Form 8829, you should also gather the other forms and schedules you will need to file your taxes. This includes your Schedule C, which shows your business income and expenses, and your Schedule A, which lists your itemized deductions.

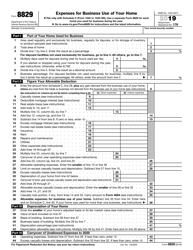

Expenses for Business Use of Your Home

Now that you have all the necessary forms, it's time to start filling out Form 8829. The first part of the form is for calculating your total expenses for the business use of your home. This includes expenses such as rent, mortgage interest, utilities, and maintenance costs. Be sure to keep accurate records of these expenses throughout the year, including receipts and bills, so that you can accurately calculate your total expenses.

Expenses for Business Use of Your Home (2015) Free Download

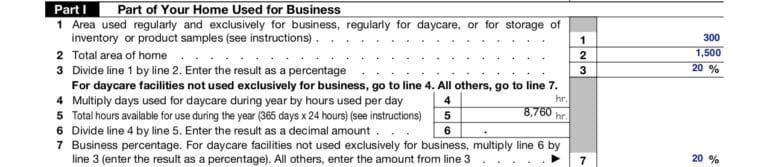

After you have calculated your total expenses, you will need to determine the percentage of your home that is used for business. This is done by dividing the square footage of your work area by the total square footage of your home. This percentage is then used to calculate how much of your total expenses can be deducted on your taxes.

How to Claim the Home Office Deduction with Form 8829

There are two methods for calculating the home office deduction: the simplified method and the regular method. The simplified method allows for a flat deduction of $5 per square foot of the home used for business, up to a maximum of 300 square feet. The regular method requires more detailed calculations, but may result in a larger deduction for those with higher expenses or larger workspaces.

Tips for Filing Your Taxes

When claiming the home office deduction, it's important to be accurate and thorough. Keep detailed records of all expenses related to your home office, including receipts and bills. Make sure you fill out all forms correctly and double-check your calculations before filing your taxes. If you're unsure about any aspect of the home office deduction or tax preparation in general, consider consulting a tax professional or accountant to ensure that you file your taxes correctly.

Ideas for Maximizing Your Deduction

In addition to the home office deduction, there are other deductions and credits available to self-employed individuals and small business owners. Be sure to research all of the potential deductions and credits that you may be eligible for, and keep accurate records throughout the year. Some examples of other deductions and credits include:

- Health insurance premiums

- Retirement plan contributions

- Travel expenses

- Marketing and advertising expenses

- Training and education expenses

How to Stay Organized Throughout the Year

One of the challenges of claiming the home office deduction is keeping accurate records throughout the year. To make this easier, consider setting up a system for tracking your expenses and storing your receipts and bills. This could include using a software program to keep track of expenses, scanning receipts and bills and storing them electronically, or creating a physical file system for paper documents.

Remember, claiming the home office deduction can help to reduce your tax burden and put more money back in your pocket. By following these tips and staying organized throughout the year, you can maximize your deduction and keep more of your hard-earned money.

Thank you for reading, and happy tax season!

If you are looking for Form 8829 - Expenses for Business Use of Your Home (2015) Free Download you've came to the right place. We have 7 Pics about Form 8829 - Expenses for Business Use of Your Home (2015) Free Download like Form 8829 - Expenses for Business Use of Your Home (2015) Free Download, IRS Form 8829 Download Fillable PDF or Fill Online Expenses for and also Download Instructions for IRS Form 8829 Expenses for Business Use of. Here it is:

Form 8829 - Expenses For Business Use Of Your Home (2015) Free Download

www.formsbirds.com

www.formsbirds.com 8829 form business use expenses tax forms

Instructions For Form 8829 - Expenses For Business Use Of Your Home

www.formsbank.com

www.formsbank.com form instructions expenses business use printable pdf

IRS Form 8829 Download Fillable PDF Or Fill Online Expenses For

www.templateroller.com

www.templateroller.com irs expenses templateroller

How To Claim The Home Office Deduction With Form 8829 | Ask Gusto

gusto.com

gusto.com irs gusto deduction

IRS Forms And Schedules You'll Need

form irs schedules forms need ll nses business use

Download Instructions For IRS Form 8829 Expenses For Business Use Of

www.templateroller.com

www.templateroller.com irs expenses templateroller

How To Claim The Home Office Deduction With Form 8829 | Ask Gusto

gusto.com

gusto.com form deduction office ii part gusto allowable figure irs

Instructions for form 8829. How to claim the home office deduction with form 8829. Form instructions expenses business use printable pdf

0 Response to "Business Use Of Home Form 8829 Form Deduction Office Ii Part Gusto Allowable Figure Irs"

Post a Comment

Dont Spam in Here Ok...!!!