How Does Venture Capital Make Money Venture Capital Valuation Method Investment Round Startup

Encrypting your link and protect the link from viruses, malware, thief, etc! Made your link safe to visit.

As entrepreneurs, you may have heard of venture capital and how it can help your business succeed. Here are some key insights and tips on how venture capital works and how you can leverage it for your startup.

What is venture capital?

Venture capital is a type of private equity financing where investors provide funding to startups and small businesses that are deemed to have high growth potential. In exchange for the funding, the investors receive equity in the startup or small business and a say in its management decisions.

How does venture capital work?

The venture capital model typically follows a four-stage process:

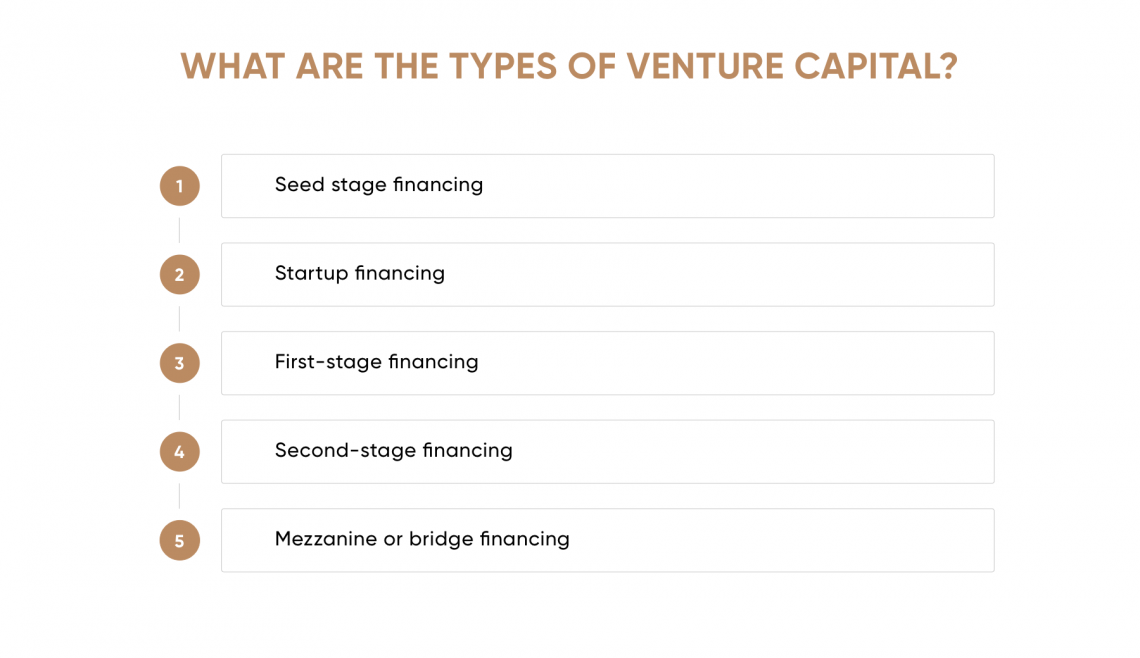

- Seed stage: This is the startup phase where the business idea is pitched to potential investors for funding. The seed stage funding helps to develop a minimum viable product (MVP).

- Early stage: This is when the startup has a proven business model and is ready to scale up. The early stage funding helps to build out infrastructure and hire additional staff.

- Late stage: This is when the startup is generating revenue and is looking to expand its operations. The late stage funding can help the startup to enter new markets or acquire other businesses.

- Exit stage: This is when the venture capital firm sells its equity stake in the startup or small business to another investor or goes public through an initial public offering (IPO).

How to attract venture capital?

Here are some tips on how to attract venture capital:

- Develop a clear pitch: Your pitch should clearly communicate your business idea, target market, and potential for growth. You should also demonstrate how your startup can solve a real-world problem.

- Build a strong team: Venture capital investors are looking for startups with a competent and experienced team. Make sure your team has the necessary skills and expertise to execute on your business plan.

- Create a business plan: Your business plan should detail your strategy for growth, market analysis, management team, financial plan, and exit strategy.

- Show traction: Investors want to see evidence that your startup is gaining traction in the marketplace. This can be in the form of user growth, revenue, or other metrics.

What are the advantages of venture capital?

Here are some advantages of venture capital:

- Access to funding: Venture capital can provide the funding necessary to get your startup off the ground and take it to the next level.

- Mentorship: Venture capitalists bring experience and expertise to the table and can provide guidance on how to grow your startup.

- Networking opportunities: Venture capitalists have extensive networks and can open doors to potential customers, partners, and investors.

- Long-term horizon: Venture capitalists are typically patient investors and are willing to wait several years for a return on their investment.

What should you know about venture capital money?

While venture capital can provide significant advantages to startups, it's important to understand the potential downsides as well. Here are some things to keep in mind:

- Equity dilution: By taking on venture capital funding, you will be diluting your ownership stake in the business. This means that you will have less control over decision-making processes.

- Risk of failure: Startups that take on venture capital funding are under pressure to perform and achieve rapid growth. This can lead to riskier business decisions and a higher risk of failure.

- Exit pressure: Venture capitalists are expecting a return on their investment within a certain timeframe. This can create pressure to sell the business or go public before it is fully ready.

What are some alternatives to venture capital?

If venture capital isn't the right fit for your startup, there are other funding options available:

- Angel investors: These are individual investors who provide funding to startups in exchange for equity. Angel investors typically invest in the seed or early stage of a startup's development.

- Crowdfunding: Crowdfunding platforms like Kickstarter and Indiegogo allow startups to raise funding from a large number of individual investors.

- Small business loans: Small business loans from banks and other financial institutions can provide the funding necessary to start or grow a business.

How to prepare for venture capital funding?

If you've decided that venture capital is the right funding option for your startup, here are some tips on how to prepare:

- Get your finances in order: Make sure you have a clear understanding of your financials and can demonstrate that you have a viable business model.

- Build relationships: Building relationships with potential investors before you need funding can help you establish trust and credibility.

- Focus on growth: Venture capitalists are looking for startups with high growth potential. Make sure you are focused on growth and have a scalable business model.

- Be patient: The venture capital fundraising process can be lengthy and time-consuming. Be patient and be prepared to dedicate the necessary time and resources to secure funding.

How does venture capital drive the U.S. economy?

Venture capital plays a critical role in driving innovation and economic growth in the U.S. economy. Here are some key stats:

- Job creation: Startups that receive venture capital funding create jobs at a higher rate than non-venture-backed firms.

- Innovation: Venture-backed startups are responsible for some of the most significant technological advances in recent years.

- Economic growth: Venture-backed firms contribute significantly to the U.S. economy and generate substantial tax revenue.

Conclusion

Venture capital can provide significant advantages to startups looking to grow and scale their business. However, it's important to weigh the potential downsides and consider alternatives if venture capital isn't the right fit. By understanding how venture capital works and how to prepare for funding, you can position your startup for success and achieve your business goals.

If you are searching about How Does Venture Capital Work | Compare the Difference Between Similar you've visit to the right place. We have 7 Pics about How Does Venture Capital Work | Compare the Difference Between Similar like How Much Does Venture Capital Drive the U.S. Economy? | Stanford, Venture Capital Explained - Infographic - All Finance Tax and also How Does Venture Capital Work | Compare the Difference Between Similar. Here it is:

How Does Venture Capital Work | Compare The Difference Between Similar

www.differencebetween.com

www.differencebetween.com exit

Starting A Venture Capital Fund : Venture Capital Wikipedia

arthurantiont67.blogspot.com

arthurantiont67.blogspot.com financing fund infograph startup

Capital Money : What Should You Know About Venture Capital Money?

www.simplycleaver.com

www.simplycleaver.com capital money venture curiosity feed should know

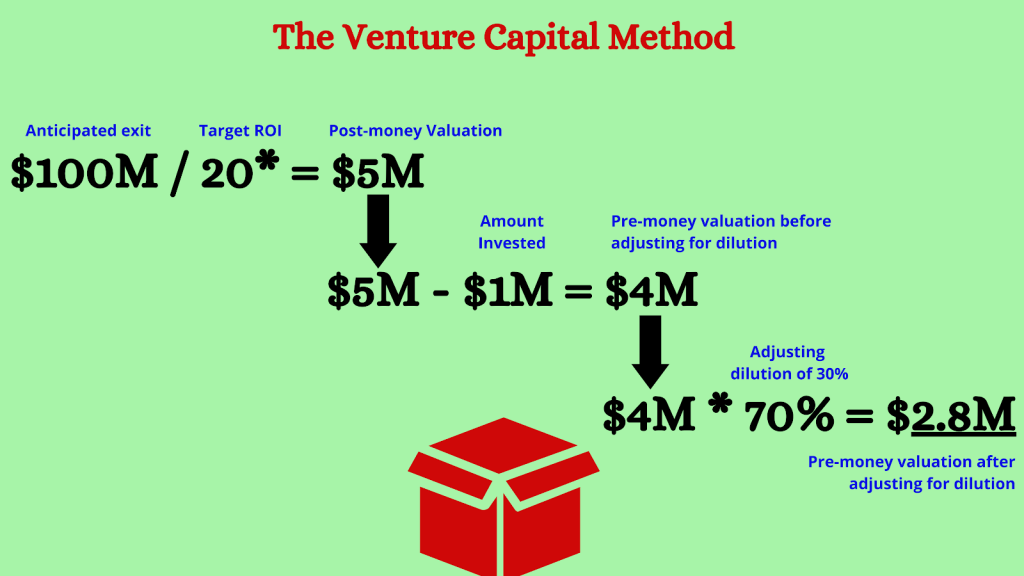

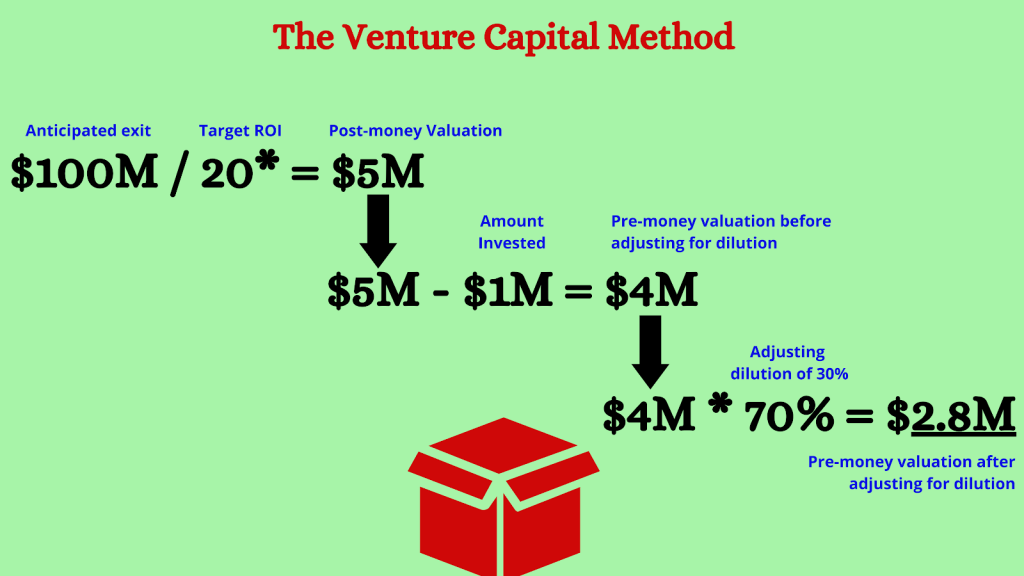

Startup Investment For Seed Round Valuation

alcorfund.com

alcorfund.com venture capital valuation method investment round startup

How Does Venture Capital Work?

capital.com

capital.com How Much Does Venture Capital Drive The U.S. Economy? | Stanford

www.pinterest.com

www.pinterest.com venture capital economy does school drive much stanford graduate business vc infographic startup startups start financing scoop poster gsb young

Venture Capital Explained - Infographic - All Finance Tax

allfinancetax.com

allfinancetax.com venture capital explained infographic business admin posted

Capital money venture curiosity feed should know. How does venture capital work. Capital money : what should you know about venture capital money?

0 Response to "How Does Venture Capital Make Money Venture Capital Valuation Method Investment Round Startup"

Post a Comment

Dont Spam in Here Ok...!!!