Business Mileage From Home Or Office Mileage Report Template

Encrypting your link and protect the link from viruses, malware, thief, etc! Made your link safe to visit.

As a professional, keeping track of your business mileage is an essential task to ensure that you receive reimbursement for any expenses incurred while on the job. In this article, we will provide you with some helpful tips and ideas on how to create an efficient mileage tracking system, as well as how to claim your business mileage expenses.

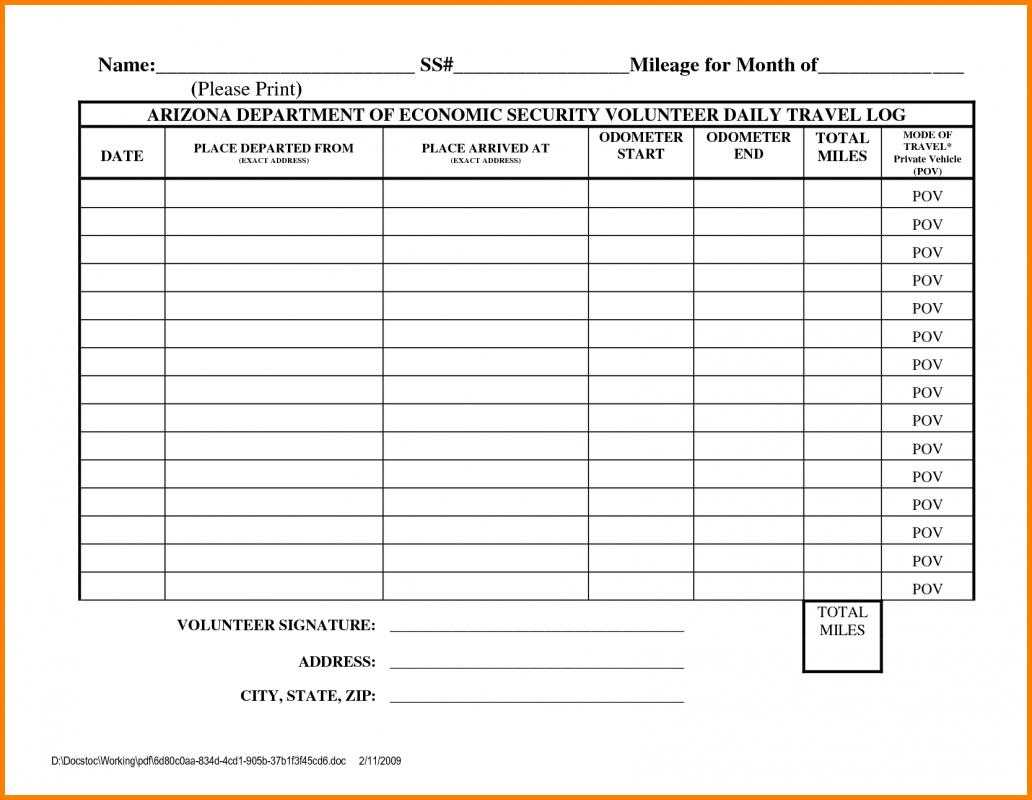

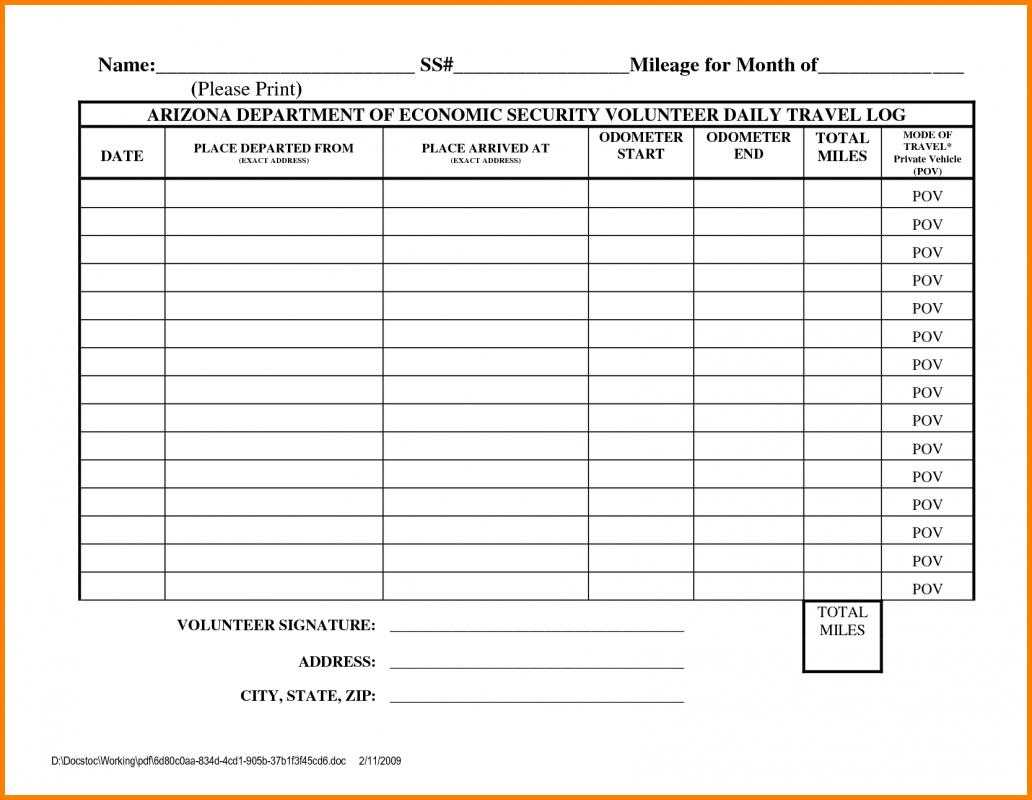

Sample Mileage Log Templates

One of the first things you should do as you start tracking your business mileage is to create a mileage log. There are many templates available online that you can use as a guide to help organize and record your mileage log. The templates come in various formats that you can choose from, such as Excel spreadsheets or printable PDFs that you can fill out manually.

Using a Mileage Report Template

If your company requires you to submit a mileage report, you can also use a pre-formatted template to help streamline your process. A mileage report template includes all the essential information required in a standard report, such as the date, starting point, destination, and the total number of miles traveled. Having a standard report format will not only save you time, but it will also ensure that your report is complete and accurate.

Business Mileage Tracker and Calculator

Another helpful tool in tracking your business mileage is a mileage tracker and calculator. With a mileage tracker, you can assign each trip a business or personal label, making it easier to determine which trips are eligible for reimbursement. Additionally, it can automatically calculate the total miles traveled and the corresponding reimbursement amount based on your company's reimbursement policy.

How to Claim Business Mileage Expenses

Now that you have a system in place to track your business mileage, the next step is to claim your expenses. The first thing you should do is to familiarize yourself with your company's reimbursement policy. Most companies have a set rate per mile, which can vary depending on the location and the type of vehicle used. Once you have determined your eligibility for reimbursement, you can start preparing your expense report.

When preparing your expense report, be sure to include all relevant information, such as the date, time, destination, purpose of the trip, and the total miles traveled. If you have used a mileage tracker or calculator, be sure to include the corresponding reimbursement amount. Additionally, attach any supporting documents, such as fuel receipts, maintenance receipts, or toll receipts, to verify your expenses.

What Business Mileage is Tax Deductible?

It is important to note that not all business mileage is tax deductible. The IRS requires that you only deduct mileage expenses that are considered "ordinary and necessary" for business purposes. Some examples of eligible expenses include travel between job sites, meetings with clients or customers, attending business conferences and seminars, and travel to the airport for business trips.

However, commuting from your home to your regular place of work is not deductible, even if you use your personal vehicle for business purposes. It is also important to keep detailed records of your expenses and mileage, as the IRS may request them during an audit.

In conclusion, tracking and claiming business mileage can be a challenging task, but with the right tools and resources, it can be a manageable and efficient process. By using a mileage log template, a mileage report template, a mileage tracker and calculator, and by familiarizing yourself with your company's reimbursement policy and the IRS tax regulations, you can save time and money, while ensuring that you receive proper reimbursement for your business expenses.

If you are looking for sample 31 printable mileage log templates free templatelab self you've came to the right page. We have 7 Pictures about sample 31 printable mileage log templates free templatelab self like Business Mileage Tracker Business Mileage Calculator Mileage - Etsy, What Business Mileage is Tax Deductible? and also What Business Mileage is Tax Deductible?. Read more:

Sample 31 Printable Mileage Log Templates Free Templatelab Self

www.pinterest.com

www.pinterest.com sample addictionary templatelab expense archaicawful

How To Claim Business Mileage & Why It’s OK For The Business

osome.com

osome.com mileage claim business who osome

Making Mileage Allowance Payments To Employees

www.accountwise.co.uk

www.accountwise.co.uk Mileage Report Template

douglasbaseball.com

douglasbaseball.com mileage template reimbursement log excel form expense spreadsheet report sheet simple paper travel farm business expenses printable templates ledger db

Business Mileage Tracker Business Mileage Calculator Mileage - Etsy

www.etsy.com

www.etsy.com mileage calculator tracker

Business Mileage Spreadsheet For The Self-Employed | Mileage Tracker

www.pinterest.co.uk

www.pinterest.co.uk What Business Mileage Is Tax Deductible?

falconexpenses.com

falconexpenses.com deductible deduction deduct deductions irs approves

Business mileage spreadsheet for the self-employed. What business mileage is tax deductible?. Mileage claim business who osome

0 Response to "Business Mileage From Home Or Office Mileage Report Template"

Post a Comment

Dont Spam in Here Ok...!!!