How Does An Ira Make Money 4. Open An Ira

Encrypting your link and protect the link from viruses, malware, thief, etc! Made your link safe to visit.

Are you planning for your future financial security and considering opening an IRA account? Do you want to know how to make your money grow over time? Well, in this article, we will discuss the basics of IRAs, how they work, and some tips to help you make the most of your investments.

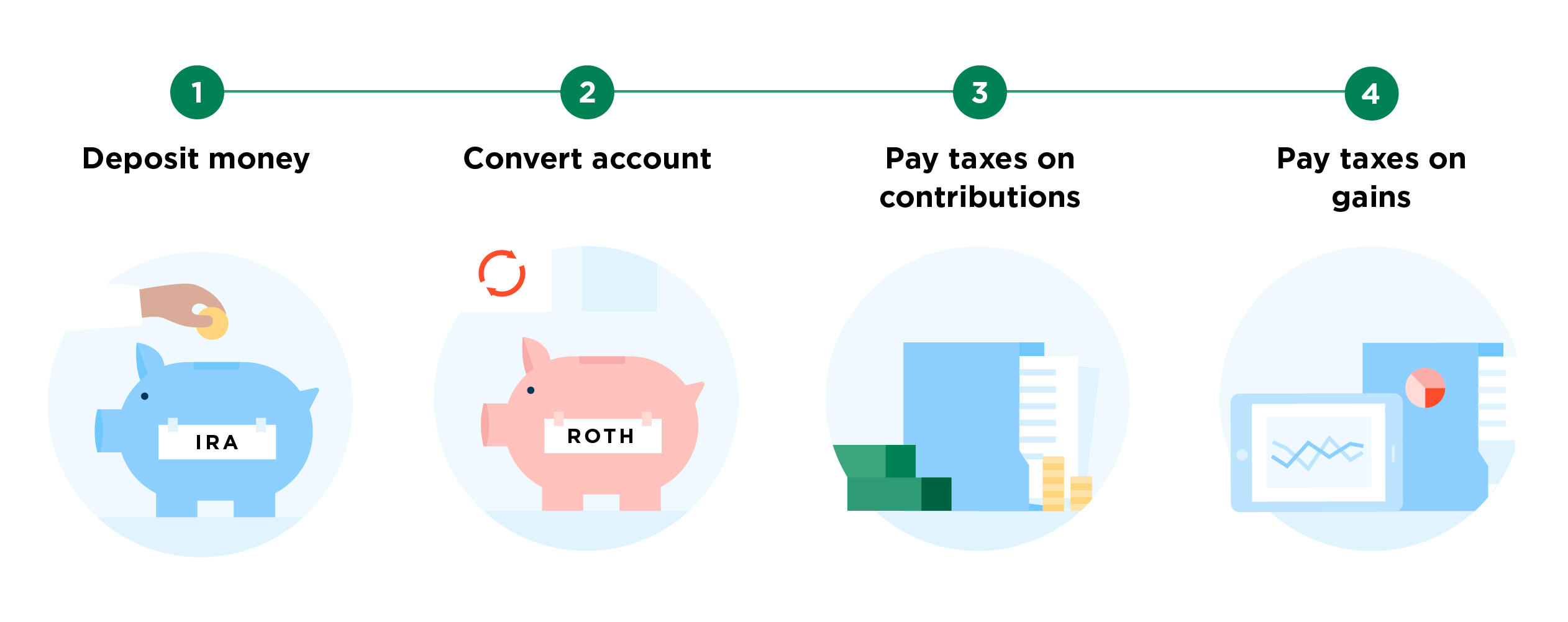

How Does Roth IRA Compound Interest?

If you're new to the world of IRAs, you might be wondering how exactly your money can grow over time. One way is through compound interest. With a Roth IRA, your money grows tax-free, meaning you won't owe taxes on any earnings or withdrawals in the future. The longer you keep your money in a Roth IRA, the more it can grow due to compound interest.

To explain, let's look at an example. Let's say you contribute $5,000 to a Roth IRA each year for 30 years. Assuming an average annual return of 8%, your initial investment of $150,000 could grow to over $1 million by the time you reach retirement age. And the best part? You won't owe any taxes on that money when you withdraw it.

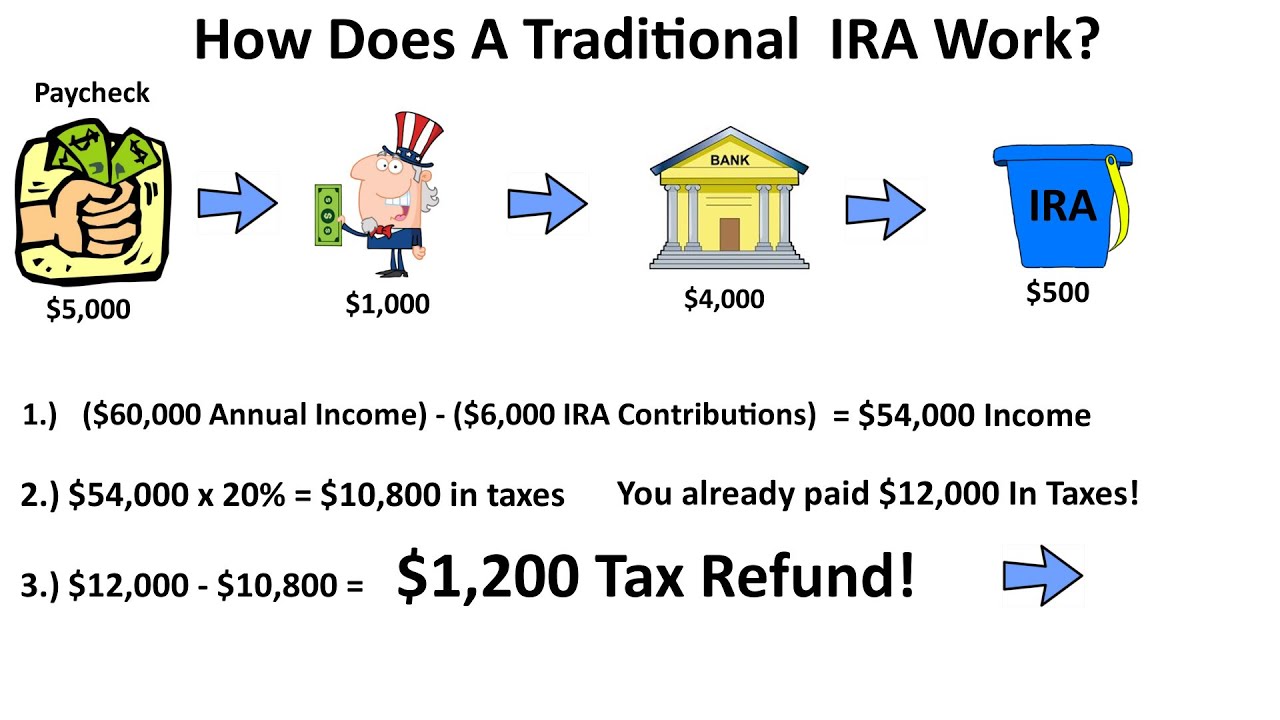

Tax Deferral Explained - Inflation Protection

Another benefit of an IRA is that it can help protect your savings from inflation. By deferring taxes on your contributions, you can effectively keep more of your money working for you over time.

For example, let's say you're in the 25% tax bracket and contribute $5,000 to a traditional IRA. That $5,000 is not taxed until you withdraw it in retirement. So effectively, that $5,000 is worth $6,666 in pre-tax income when you contribute it. Assuming an inflation rate of 3%, that $6,666 will be equal to approximately $14,200 in 30 years. Even if you withdraw that $14,200 in retirement and have to pay taxes on it at a 25% rate, you'll still have more money than if you had paid taxes on the $5,000 up front.

How Does an IRA Work? The Plain and Simple Basics

So, now that you know some of the benefits of an IRA, let's dive into how they work. Simply put, an IRA is a type of investment account that you can use to save for retirement. There are two main types of IRAs: traditional and Roth.

With a traditional IRA, your contributions are tax-deductible, meaning you can lower your taxable income for the year in which you make the contribution. However, you will owe taxes on the money you withdraw in retirement. With a Roth IRA, your contributions are made with after-tax dollars, meaning you won't owe taxes on any growth or withdrawals in retirement.

In both cases, your money is invested in stocks, bonds, mutual funds, or other securities. Over time, your investments will hopefully grow and generate earnings. It's important to note that the value of your investments may fluctuate over time, and there is always a risk that you could lose money.

What Is an IRA?

Now that you know the basics of how IRAs work, why should you consider opening one? There are several reasons:

- IRAs offer tax-advantaged savings, meaning you can keep more of your money working for you over time.

- IRAs are generally easy to open and manage, and you can contribute to them on a regular basis.

- IRAs offer a wide range of investment options, so you can choose the ones that fit your individual financial goals and risk tolerance.

Roth IRA: The EASIEST Way To Become A MILLIONAIRE

There are many tips and strategies to help you make the most of your IRA investments, but perhaps the easiest way to grow your wealth over time is by maximizing your contributions to a Roth IRA.

As we mentioned earlier, one of the benefits of a Roth IRA is that your contributions are made with after-tax dollars, meaning you won't owe taxes on any growth or withdrawals in retirement. So, the more you can contribute each year, the more your money can grow through compound interest over time.

Here are some tips to help you make the most of your Roth IRA investments:

- Contribute the maximum amount allowed each year. In 2021, the maximum contribution is $6,000 if you're under age 50, or $7,000 if you're 50 or older.

- Start contributing early. The earlier you start contributing to a Roth IRA, the more time your money will have to grow and compound.

- Choose the right investments. Your IRA provider will likely offer a range of investment options, including stocks, bonds, mutual funds, and more. Consider your risk tolerance and financial goals when choosing your investments.

- Rebalance your portfolio periodically. It's important to periodically review and adjust your investment portfolio to ensure that it aligns with your financial goals and risk tolerance.

By following these simple tips and strategies, you can maximize your IRA contributions and grow your wealth over time. Remember, the key to successful retirement planning is to start early, invest wisely, and stay consistent over time.

If you're interested in learning more about IRAs and other retirement planning strategies, consider consulting with a financial advisor or accountant who specializes in retirement planning. They can help you evaluate your individual financial situation and develop a customized plan to help you achieve your retirement goals.

If you are looking for What Is an IRA? | Money.com you've visit to the right place. We have 7 Pics about What Is an IRA? | Money.com like How Many Beneficiaries Can I Have for IRA Accounts?, What Is an IRA? | Money.com and also How Does Roth IRA Compound Interest?. Here it is:

What Is An IRA? | Money.com

money.com

money.com ira

How Does Roth IRA Compound Interest?

www.thewowstyle.com

www.thewowstyle.com ira backdoor roth interest does compound iras traditional money set conversion tax wealth vehicles building around why earn nerdwallet

Tax Deferral Explained - Inflation Protection

inflationprotection.org

inflationprotection.org How Many Beneficiaries Can I Have For IRA Accounts?

www.aarp.org

www.aarp.org ira aarp beneficiaries

Roth IRA: The EASIEST Way To Become A MILLIONAIRE - YouTube

www.youtube.com

www.youtube.com ira roth millionaire become

4. Open An IRA - 6 Things You Can Do Right Now That'll Make You Rich

money.cnn.com

money.cnn.com money ira rich essentials ll right things make

How Does An IRA Work? The Plain And Simple Basics

www.iravs401kcentral.com

www.iravs401kcentral.com ira work does retirement sandwich parenting generation until basics simple different take works plain chances heard unsure reason probably ve

How does an ira work? the plain and simple basics. How many beneficiaries can i have for ira accounts?. How does roth ira compound interest?

0 Response to "How Does An Ira Make Money 4. Open An Ira"

Post a Comment

Dont Spam in Here Ok...!!!