How Does Insurance Company Make Money Who Can Getting A Guarantor For A Financial Loan? – Lrn Global

Encrypting your link and protect the link from viruses, malware, thief, etc! Made your link safe to visit.

When it comes to insurance, many people wonder how insurance companies actually make money. It's a valid question, and understanding the answer can help you make smarter decisions when it comes to purchasing insurance policies for yourself, your family, and your business. Below, we'll break down the factors that contribute to an insurance company's profitability.

First and foremost: premiums

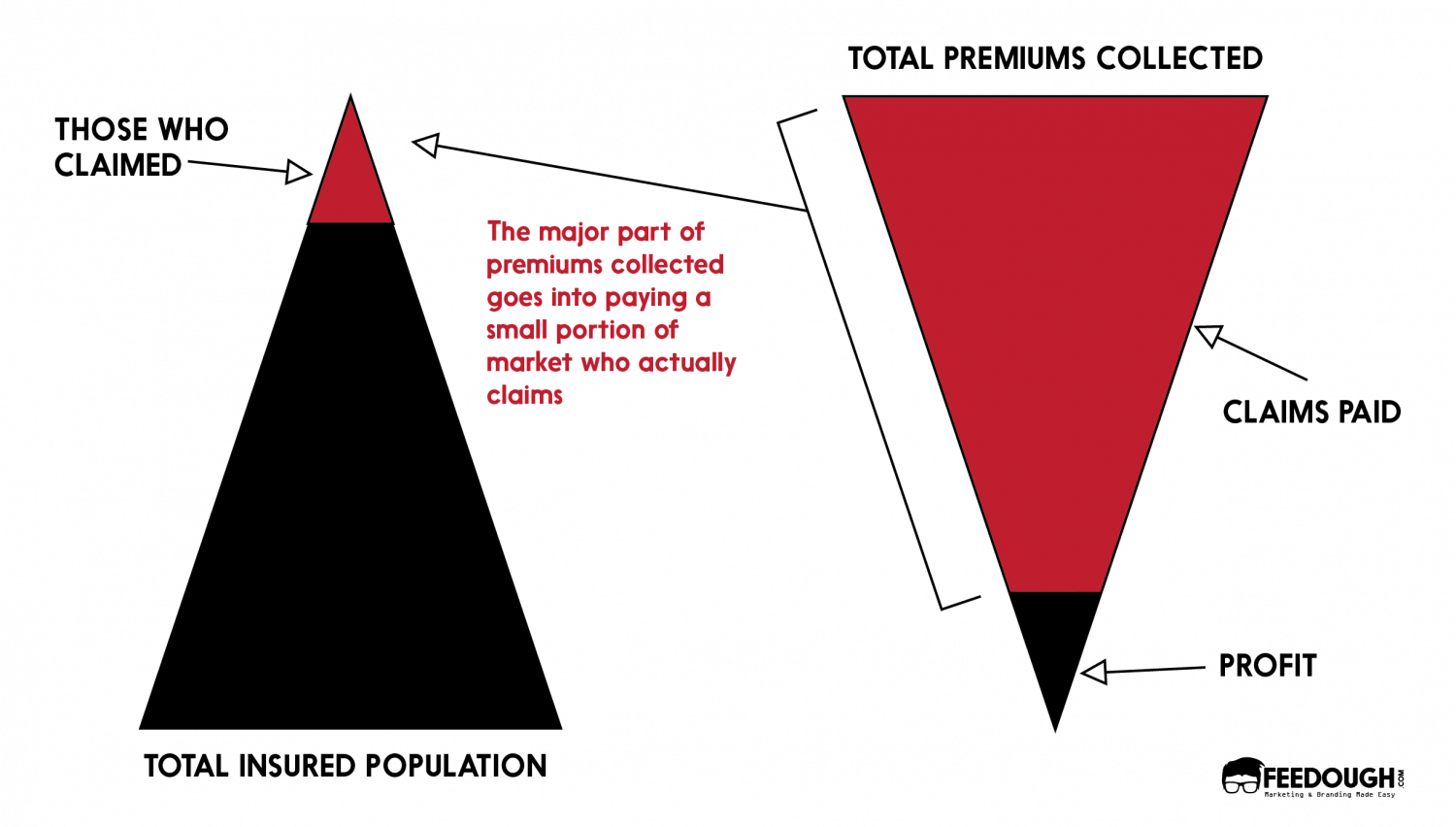

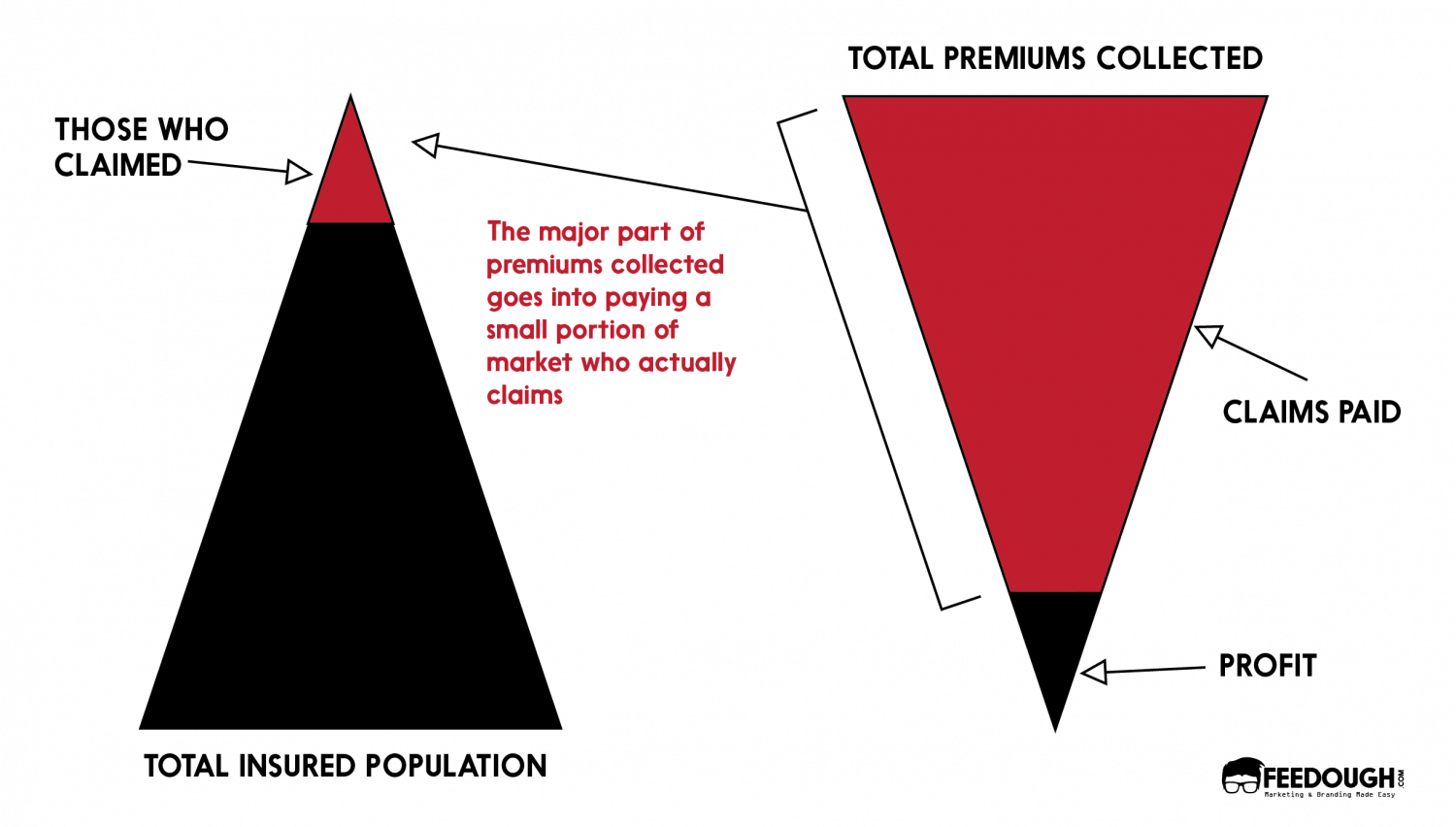

The primary way that insurance companies make money is through collecting premiums. When you purchase a policy, whether it's for health insurance, car insurance, or another type of coverage, you pay a monthly or annual premium to your insurance company. That premium is based on a variety of factors, including your age, your health status, your driving record, and the level of coverage you choose.

Insurance companies use complex algorithms and risk models to determine the amount of risk associated with insuring you, and they calculate your premium accordingly. If you're considered a high-risk customer – for example, if you have a history of traffic violations or health problems – your premium will typically be higher than if you're considered a low-risk customer.

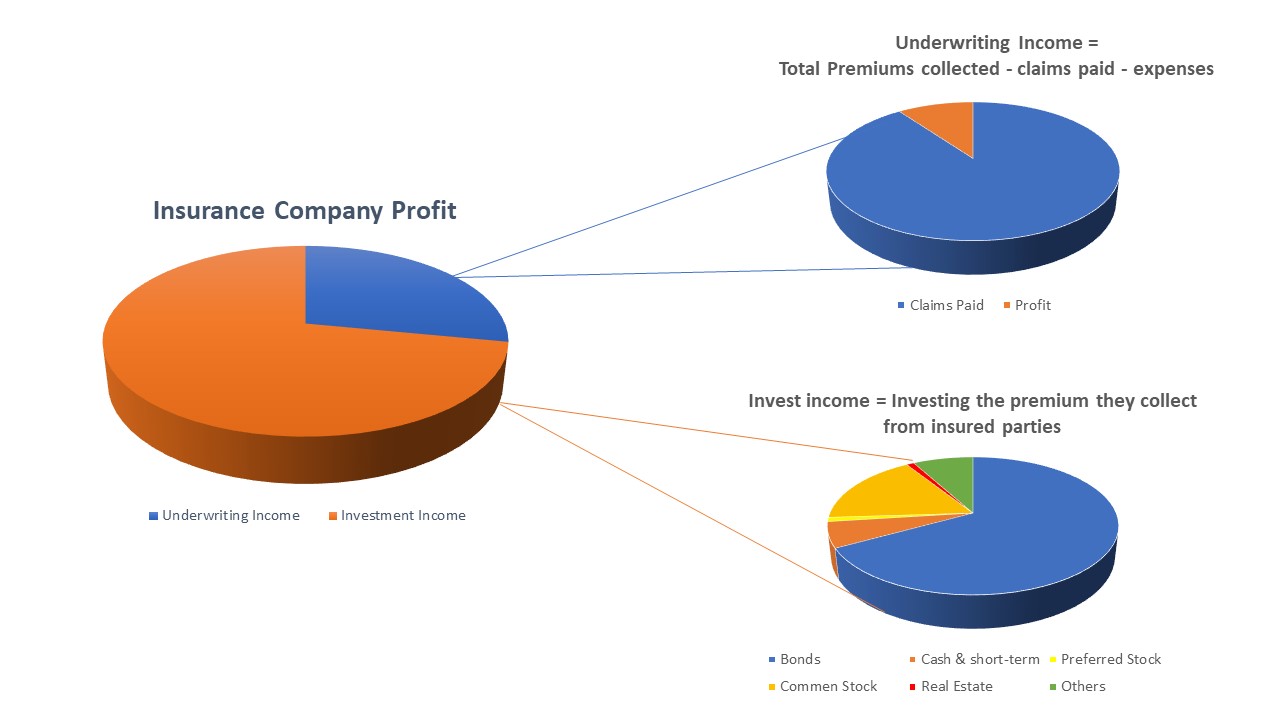

The key for insurance companies is to set premiums at a level that will allow them to cover their costs and still generate a profit. They do this by analyzing data on past claims, assessing the level of risk associated with each policyholder, and adjusting their pricing accordingly.

Investments can also play a role

In addition to collecting premiums, insurance companies can also generate revenue through investments. Because they hold large amounts of capital in reserve – which they need to cover potential losses – insurance companies can invest that money in various securities and other financial instruments.

The returns on those investments can help boost an insurance company's profits, even if they experience a higher-than-expected number of claims in a given year. However, investing can also be a risky proposition, and insurance companies must be careful to balance the potential for gains against the risk of losses when making investment decisions.

Controlling costs is key

Another important factor in an insurance company's profitability is their ability to keep their costs under control. Insurance companies are in the business of managing risk, which means they need to be prepared to pay out claims when their customers experience losses. However, they also need to be careful not to overpay on claims – otherwise, they'll eat into their profits.

One way that insurance companies control costs is by negotiating favorable rates with healthcare providers, auto repair shops, and other vendors. By working with these partners to reduce the cost of services, insurance companies can help keep their overall expenses lower.

Insurance companies also invest in technology and other tools to streamline their operations and improve efficiency. By automating processes and eliminating waste, they can save money and improve their bottom line.

Final thoughts

So there you have it – the primary ways that insurance companies make money. By collecting premiums, generating investment income, and controlling costs, they are able to generate a profit while still providing valuable coverage to their policyholders. If you're in the market for insurance, it's important to do your research and choose a provider that offers the right blend of coverage, affordability, and customer service.

Tips for choosing an insurance company

Consider the level of coverage

When shopping for insurance, it's important to evaluate the level of coverage that each provider offers. Make sure you understand what's included in each policy and what the limitations are, so you can make an informed decision.

Compare premiums

Premiums can vary widely from one insurance company to another, so it's important to shop around and compare rates. Keep in mind that the cheapest policy may not always be the best value – you need to consider both the price and the level of coverage.

Read reviews and ratings

Before selecting an insurance company, take the time to read reviews and ratings from other customers. Look for providers with high satisfaction ratings and positive reviews, and avoid those with a history of poor customer service or claims handling.

How to file an insurance claim

If you need to file an insurance claim, it's important to follow these steps to ensure that the process goes smoothly:

1. Report the incident as soon as possible

Whether you're filing a claim for car insurance, health insurance, or another type of coverage, it's important to report the incident as soon as possible. This will allow your insurance company to begin processing the claim and determine the amount of coverage you're eligible for.

2. Provide all necessary information

Be prepared to provide detailed information about the incident or loss, including the date and location, any parties involved, and any relevant documents or receipts. The more information you can provide, the easier it will be for your insurance company to process the claim.

3. Follow up regularly

Throughout the claims process, stay in touch with your insurance company and follow up regularly to ensure that everything is progressing smoothly. If there are any complications or delays, don't hesitate to ask questions and seek clarification.

Final thoughts

Insurance can be a complex and sometimes confusing topic, but by understanding how insurance companies make money and what to look for when choosing a provider, you can make informed decisions that protect your financial well-being. Remember to compare premiums, evaluate coverage levels, and read reviews before choosing a provider, and don't hesitate to seek assistance if you need guidance on filing a claim or navigating the insurance process.

Image sources

Image 1:

Image 2:

Image 3:

Image 4:

Image 5:

If you are looking for How does insurance company make money? | Jordan & Jordan you've visit to the right page. We have 7 Pictures about How does insurance company make money? | Jordan & Jordan like How does insurance company make money? | Jordan & Jordan, How Does Health Insurance Company Make Money? and also PRIME TIME. Read more:

How Does Insurance Company Make Money? | Jordan & Jordan

www.jordanjordaninsurance.com

www.jordanjordaninsurance.com insurance money make company does

How Do Insurance Companies Make Money? [Complete Guide]

![How do Insurance Companies Make Money? [Complete Guide]](https://emozzy.com/wp-content/uploads/2020/10/Webp.net-compress-image-5.jpg) emozzy.com

emozzy.com emozzy

How Do Insurance Companies Make Money? | Feedough

www.feedough.com

www.feedough.com insurance companies money make feedough

PRIME TIME

primetime8.blogspot.com

primetime8.blogspot.com How Does Health Insurance Company Make Money?

theremotebiz.com

theremotebiz.com does unbelievable

Who Can Getting A Guarantor For A Financial Loan? – LRN Global

How Do Insurance Companies Make Money? - Quora

insurance money companies make realize manage income investment expenses generally profit underwriting control they if

How do insurance companies make money?. How do insurance companies make money? [complete guide]. Insurance companies money make feedough

0 Response to "How Does Insurance Company Make Money Who Can Getting A Guarantor For A Financial Loan? – Lrn Global"

Post a Comment

Dont Spam in Here Ok...!!!