Home Business Vs Hobby Gratification Delayed Hobby Vs Work Business Success Delay Comes Does Column Wins Months Number Little

Encrypting your link and protect the link from viruses, malware, thief, etc! Made your link safe to visit.

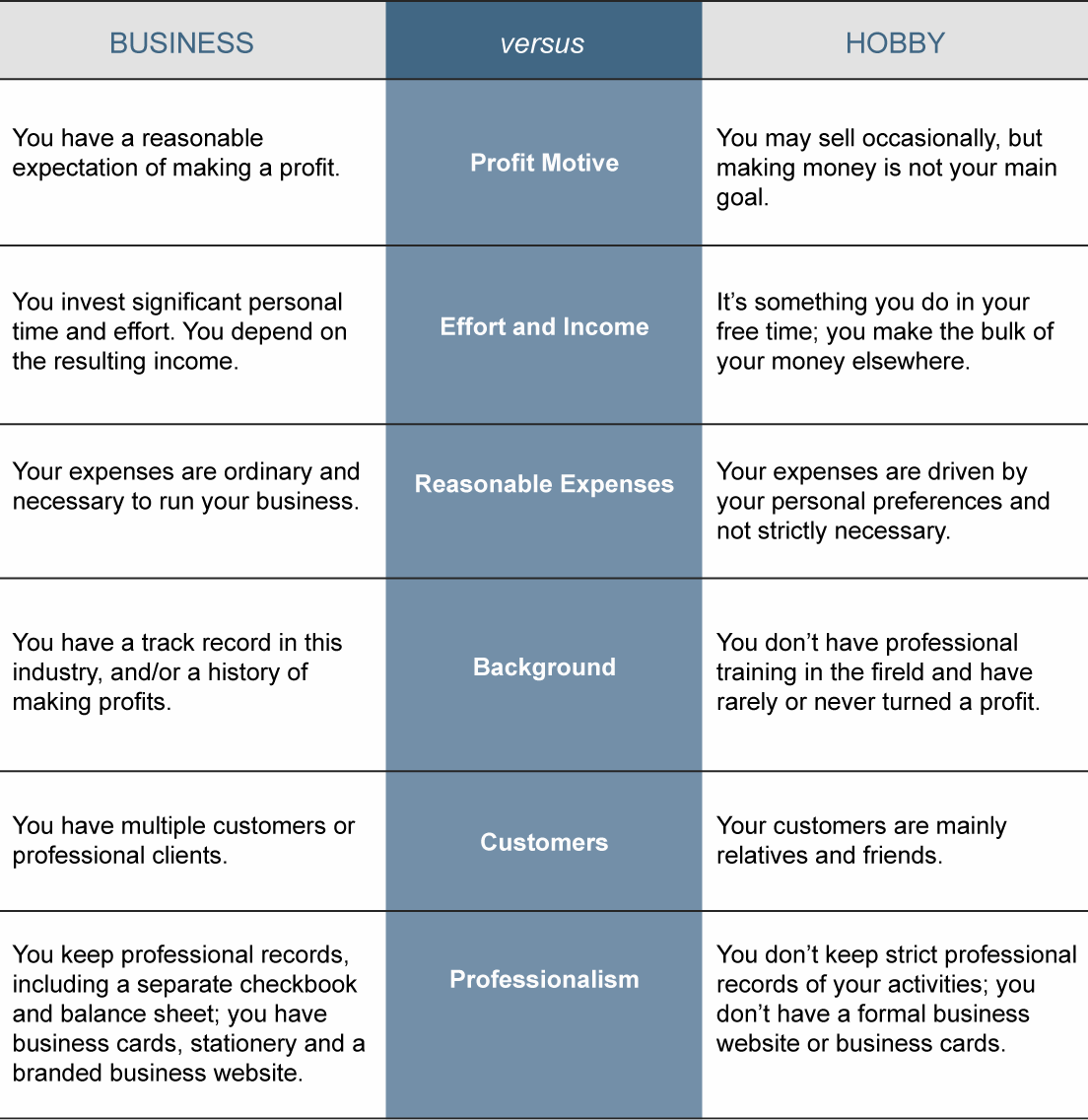

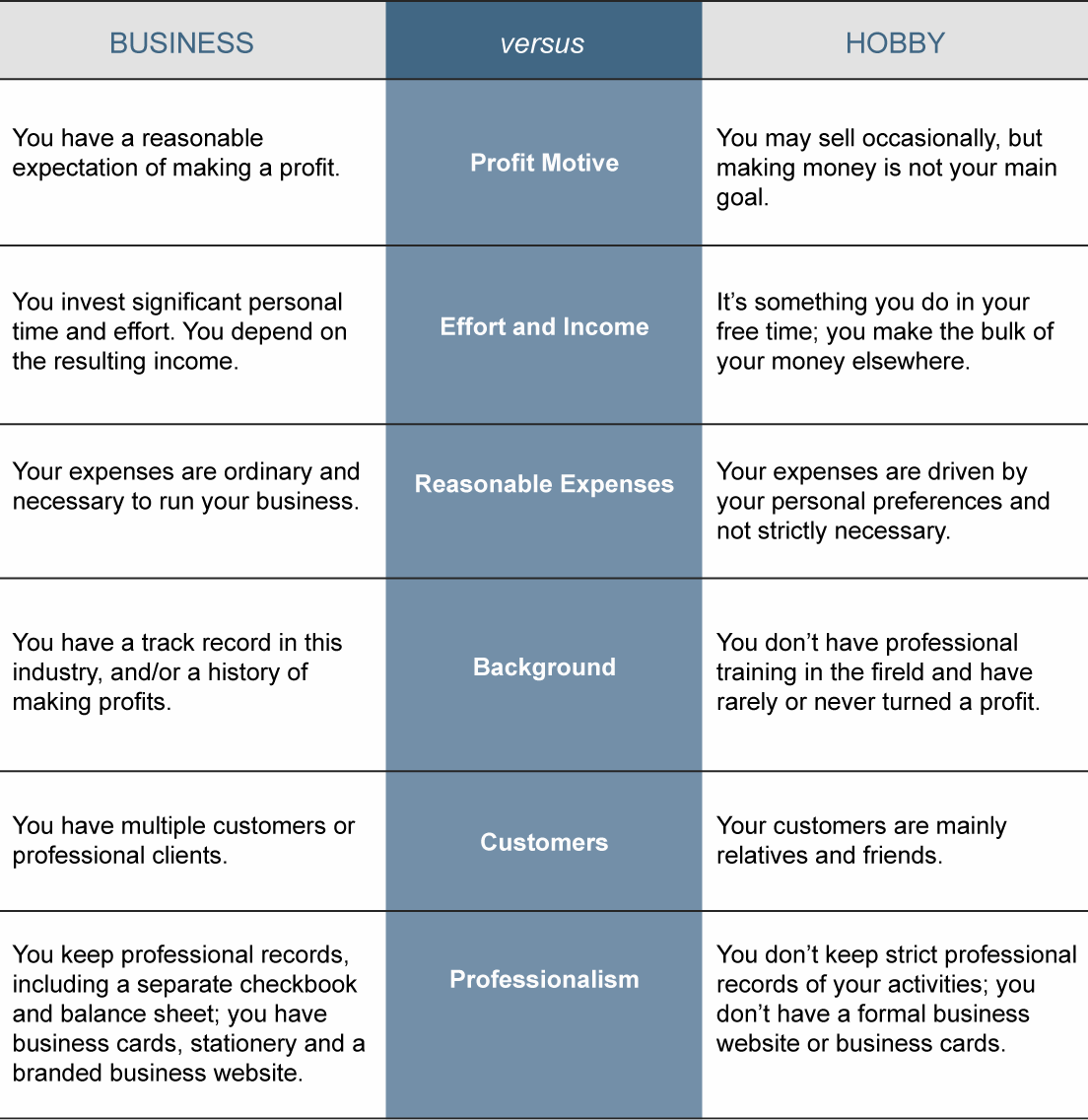

Are you thinking about turning your hobby into a business? It can be an exciting and fulfilling venture, but it's important to understand the difference between a hobby and a business for tax purposes. Here's a breakdown:

Hobby vs Business

According to the IRS, a hobby is an activity that you engage in for pleasure or recreation, rather than for profit. A business, on the other hand, is an activity that you engage in for the primary purpose of making a profit. The IRS has specific guidelines that determine whether an activity is a hobby or a business. These guidelines include:

- The manner in which the activity is carried on

- The expertise of the taxpayer or their advisors

- The time and effort expended by the taxpayer in carrying on the activity

- The expectation that assets used in the activity may appreciate in value

- The success of the taxpayer in carrying on other similar or dissimilar activities

- The taxpayer's history of income or losses with respect to the activity

- The amount of occasional profits, if any, which are earned

- The financial status of the taxpayer

- Whether the activity is personal pleasure or recreation

Tax Benefits

If your hobby is considered a business, you may be eligible for tax deductions. Deductible expenses include:

- Advertising and promotion

- Office supplies and equipment

- Travel expenses

- Insurance

- Home office expenses

- Legal and professional services

- Phone and internet expenses

- Meals and entertainment

- And more

How to Turn Your Hobby into a Business

If you're ready to turn your hobby into a business, here are some tips to get started:

- Research your market: Determine if there is demand for your product or service.

- Develop a business plan: This will help you determine the viability of your business and set goals for growth.

- Register your business: Choose a business structure (such as sole proprietor, LLC, or corporation) and register your business with your state.

- Obtain licenses and permits: Depending on your business, you may need to obtain licenses and permits to operate legally.

- Build your brand: Develop a unique brand identity and marketing strategy to attract customers.

- Set up a workspace: Whether it's a dedicated room in your home or a storefront, create a workspace that is conducive to productivity.

- Establish a pricing strategy: Determine how you will price your product or service to ensure profitability.

- Manage your finances: Keep track of your income and expenses and consult with a tax professional to ensure compliance.

- Stay organized: Set up systems to manage your inventory, orders, and customer interactions.

- Stay motivated: Pursuing your hobby as a business can be challenging, but staying motivated and committed to your goals will help you succeed.

Conclusion

Turning your hobby into a business can be a rewarding experience, but it's important to understand the tax implications and take the necessary steps to ensure compliance. Use these tips to get started and consult with a tax professional to maximize your tax benefits.

If you are looking for Turning Your Hobby Into a Business | Tax Benefits | Blog Post you've came to the right page. We have 7 Images about Turning Your Hobby Into a Business | Tax Benefits | Blog Post like Do you need an ABN? Business vs Hobby (Side Hustle) - YouTube, Business vs Hobby | IRS vs Network Marketer – Home Biz Tax Lady and also What is a CPA | Why Do You Need A CPA For Your Business. Here it is:

Turning Your Hobby Into A Business | Tax Benefits | Blog Post

thecbagroup.com

thecbagroup.com hobby

Success Comes From Delayed Gratification, Or Does It? | Pick A

gratification delayed hobby vs work business success delay comes does column wins months number little

Business Vs Hobby | IRS Vs Network Marketer – Home Biz Tax Lady

homebiztaxlady.com

homebiztaxlady.com What Is A CPA | Why Do You Need A CPA For Your Business

accounting-services-cpa.com

accounting-services-cpa.com cpa

Hobby Vs Business - YouTube

www.youtube.com

www.youtube.com Do You Need An ABN? Business Vs Hobby (Side Hustle) - YouTube

www.youtube.com

www.youtube.com hustle

When Is It A Hobby Vs A Business? – Hard Working Mom

hardworkingmom.com

hardworkingmom.com hobby vs business mom when versus considered whether disability security question money social then making if

Turning your hobby into a business. Gratification delayed hobby vs work business success delay comes does column wins months number little. Hobby vs business

0 Response to "Home Business Vs Hobby Gratification Delayed Hobby Vs Work Business Success Delay Comes Does Column Wins Months Number Little"

Post a Comment

Dont Spam in Here Ok...!!!